Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

FEATURE: Inexorable, but slow - the march of Blu-ray Discs

Notwithstanding Blu-ray’s impressive gain – sales more than doubled in 2009 – it is not enough to compensate for declining consumer spending on DVD. HELEN DAVIS JAYALATH, Senior Analyst at Screen Digest, assesses the performance of packaged media in 2009 and its outlook for 2010.

European consumer spending on Blu-ray purchasing more than doubled to €790m, or 6.9% of total European spending on buying video discs in 2009. But with DVD retail spending falling 8.4% in the year, BD’s impressive gain was insufficient to prevent a downturn (of 4.4%) in overall consumer spending on buying discs.

As a result, total consumer spending on the purchase and rental of physical media in 17 West European and five CE European territories declined for the fifth consecutive year, slipping 4.9% to $9.5bn when calculated at fixed 2009 exchange rates.

Just over 6% of this figure – up from 2.5% in 2008 – was generated by the sale and rental of Blu-ray, with DVD accounting for almost 94% of spending.

Despite being positioned – like DVD before it – as a retail product, BD is also slowly beginning to emerge as a rental format in Europe. In 2009 the hi-def format accounted for just over three per cent of European rental spending, according to Screen Digest analysis, compared with its share of 6.9% of retail spending. But this was not enough to reverse the downwards trend in total rental spending, which fell 11% to €1.2bn.

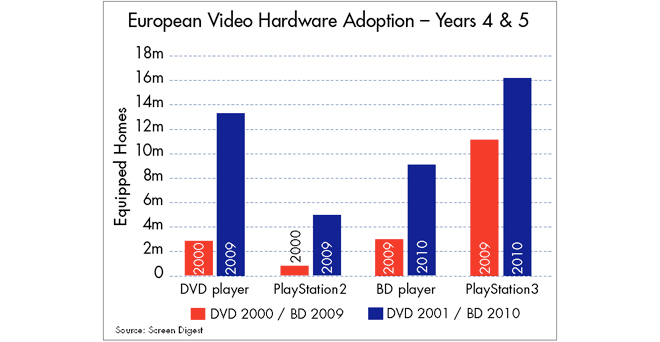

Sales of standalone BD hardware are lagging those of DVD at a similar stage of that format’s evolution. Sony’s BD-compatible PlayStation3 still dominates the sector, accounting for almost 80% of the installed base of BD hardware. However, the primary function of the PS3 as a games console means that relatively few of these households are active buyers and renters of BD video software.

As dedicated BD hardware prices fall still further, to the point that they become barely more expensive than DVD players, we expect sales of standalone players to increase substantially, even as the increasing age of the current generation of console games hardware causes PS3 sales to slow. As a result, the balance will gradually shift and by 2014 we expect standalone BD players and recorders to account for two thirds of the European BD installed base.

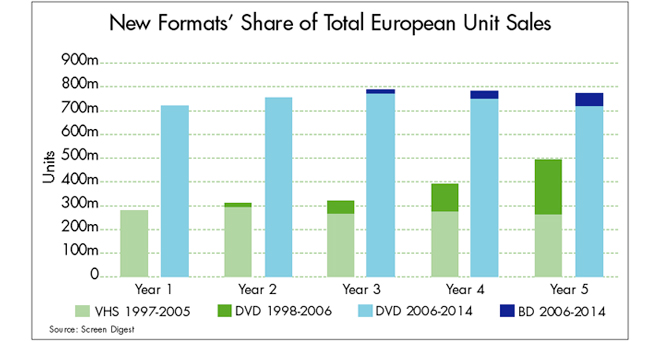

However, despite this strong growth in dedicated players, Screen Digest expects many consumers to stick with the ‘good enough’ DVD format for most packaged media purchases, even after they acquire a BD player. This assumption reflects the multiple factors of backwards compatibility, the higher cost of hi-def software and the perception – especially on the sub 45-inch screens that are more common on this side of the Atlantic – that DVDs played on BD hardware offer a more-than-satisfactory viewing experience. As a result, Screen Digest continues to expect BD conversion rates (the proportion of sales made on the new format) to significantly lag those of DVD vs. VHS at a similar stage in the product's life cycle in all key markets.

In 2009, four years after its launch, BD accounted for just 3.5% of the 778 million physical video units sold to European consumers, according to Screen Digest analysis. Although the total number of video units sold annually has more than doubled since 2000 (DVD’s fourth year of sale), that year the new DVD format accounted for over 16% of unit sales.

The reasons for this difference can clearly be seen at title level. Screen Digest analysis of data from the British Video Association indicates that just two Top 30 releases (Terminator: Salvation and Star Trek 11) achieved more than 20% of their volume sales on the new format in the UK in 2009, compared with 16 titles achieving this benchmark on the then-four-year-old DVD format in 2000.

The situation appears better in Germany, where the best-selling titles of 2009 achieved as much as 40% of their sales on BD, but this is in part a reflection of the country’s traditionally low level of DVD sales. Across the total German market in 2009 the BD conversion rate was still just 5.7%, compared with almost 39% for DVD in 2000. In France, where five movies achieved a conversion rate of over 20%, the format’s overall share was 4.8%.

And contrary to some reports, even James Cameron’s record-breaking Avatar is unlikely to change this situation. As expected – given the combination of the biggest box office hit of all time and a steadily expanding installed base of hardware – the title has smashed BD sales records worldwide, but it’s also selling extremely well on DVD. And unlike in the US, where Screen Digest analysis of Nielsen VideoScan data shows the title sold an incredible 50% of units on BD in its first four days, BD's initial share of sales in the UK was not significantly higher than that of other recent releases.

One factor which may have contributed to British consumers’ reluctance to upgrade to the BD (which came bundled with a DVD copy anyway) is the pricing differential between it and the DVD-only version. While US consumers could expect to pay around $4 more for the hi-def option, a week-one DVD price war between British retailers meant that the DVD (SRP £24.99) was available for as little as £8 in some supermarkets, barely half the £15 generally charged for the BD (SRP £33.99). Screen Digest believes that persistent discounting of the standard definition format could significantly depress Blu-ray adoption by making the hi-def format seem simply too expensive by comparison.

One way to address this – and one which would be in keeping with the video industry’s traditional approach to disappointing sales – would be to reduce BD prices and thus the differential. The theory is that lowering prices increases unit volume sufficiently to more than offset the lost gross margin from the price reduction and encourages format adoption. It’s true that retail analysis has shown that such strategies did help maintain DVD sales volume towards the latter end of the format’s growth cycle. However, Screen Digest analysis suggests that applying this approach to BD, which is still at the ‘early adopter’ stage, could risk leaving serious money on the table.

For example, by the end of its fourth year of availability (2009), the average price of a Blu-ray Disc in West Europe had fallen by 19% to €18.65. By comparison, DVD prices fell just 12% (at fixed exchange rates) in the first four years, to €23.27. This is despite a stronger product mix on BD, including more special edition films and expensive TV boxsets, compared to the feature film-heavy skew of early DVD. The biggest reason for this difference is that pricing strategies developed for the decade-old DVD format – aggressive pricing of new releases and rapid progression to catalogue promotions – are already being applied to BD.

Of course, price declines are to be expected on a new format. But the current promotions, often accompanied by even more aggressive discounts on DVDs, go much further. We believes there is a real risk that today’s pricing strategies could irrevocably undermine the perceived value of both formats accelerating the downward spiral in market value.

Based on current forecast, Screen Digest reckons that, despite the gradual shift to higher-priced BDs, European consumer spending on buying physical video formats will fall to €6.6bn annually in 2014, down from €8.2bn in 2009. In view of this, it is more important than ever that studios manage their home entertainment pricing strategies carefully if they are to maximize returns from the hi-def format.

By using our dynamic forecasting model to build ‘what if’ scenarios, we has assessed the potential impact of increasing or reducing the BD premium. Perhaps counter-intuitively, our analysis indicates that if the BD premium could be maintained at over 50% through to 2014, consumer spending in West Europe could be increased by around €800 million cumulatively over the next five years. On the other hand, if the premium were to shrink to just 13% by 2014, studios could be leaving up to €750 million on the table over the same period. In other words, the cumulative difference between the best and worst case scenarios over the next five years could be as great as €1.6bn.

If studio pricing policies remain in line with our current expectations, BD purchase will account for 34% of total European spending on buying physical video formats by 2014, spending which will, in turn, have fallen by 25% since 2007, from €8.8bn to €6.6bn. When physical rental, digital retail and rental and TV-based VoD are included in the equation, international spending on home entertainment is expected to reach $10bn in 2014, for a more modest 14% decline from 2007’s comparable figure.

Biography

HELEN DAVIS JAYALATH heads Screen Digest's Video team and has overall responsibility for the company's coverage of the packaged media business. Helen has been analysing the global video business since 1991 and is acknowledged as the leading expert in the field. Contact: www.screendigest.com

This is one of the many high-caliber analyses in the annual DVD and Beyond 2010 magazine. Ask for your free copy.

Story filed 22.08.10