Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

ANALYSIS: Demand for mobile content finally here, but can the industry profit?

2009 was the most successful year for mobile content ever despite a difficult economic climate and a declining handset market, says Screen Digest in its latest research. The market awakening was primarily due to the success of Apple's App Store and is set to bring mobile to the forefront of the media industry in 2010 and beyond. However, mobile TV is still to make market inroads.

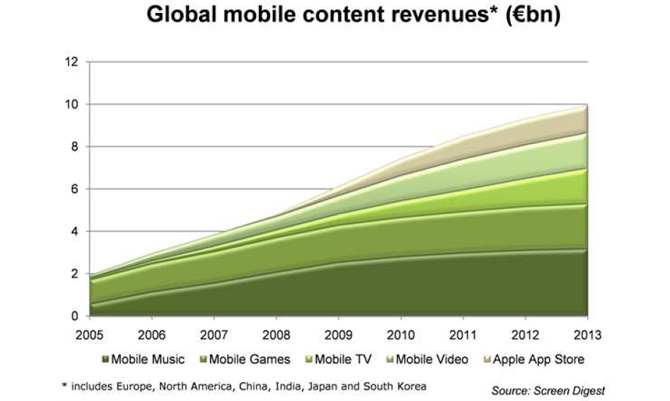

Revenues from applications other than voice and messaging on mobile are set to double in the next four years to reach €100bn a year by the end of 2013. Some €8.6bn of this will be generated by rich media content services such as mobile TV, video, games and music, a growth of 50% compared to the end of 2009. The bulk of the remainder will comprise charges for data.

More than half a decade after the launch of 3G, the industry has finally found the right ingredients to provide a compelling user experience on mobile. The increasing popularity of smartphones with multimedia capabilities as well as the emergence of more open distribution channels such as Apple's App Store and Google's Android Market has ignited the mobile content market.

According to the latest Screen Digest research, Apple's App Store will generate €1.3bn by the end of 2013 from 7 billion downloads. Not all applications stores will achieve the same level of success and the smartphone/application store model will take some time to reach mass market adoption.

The exploding number of application stores and corresponding development platforms poses a danger – creating unnecessary market fragmentation. Screen Digest believes market consolidation is a long way off as the huge corporations behind those application stores – Apple, Google, Nokia, Samsung, Microsoft, Vodafone and Orange – will be happy to compete with each other, and the sheer size of the mobile market will offer enough room for all of them to co-exist.

Although the media industry is still a long way from generating as much revenue from mobile as it does from other platforms, it will help offset the decline of physical sales while offering new hopes for monetization.

In the music industry, mobile is used by online music-on-demand companies such as Spotify and Deezer to upscale consumers from free to premium services. Revenues from mobile music services are set to grow by 25% in the next four years, reaching €3.2bn by the end of 2013 despite a substantial decline in ringtone sales.

The direct publishing route that mobile applications offer pushes video games publishers up the value chain, removing the need to license content. Revenues from mobile games sold through operators' portals and Apple's App Store are expected to grow by 40% in the next four years, reaching €2.8bn by the end of 2013.

Screen Digest is confident that as mobile handsets increasingly converge with portable media players, the demand for paid-for mobile Video on Demand (VoD) will rise and mobile will eventually become a substantial contributor to the global VoD market. Mobile builds a much better case for subscription-based VoD services since, unlike the home environment, the content cannot be accessed free elsewhere at the time of demand. As a result, mobile video revenues will double in the course of the next four years to €1.7bn, with most of the growth expected in 2010.

While 2009 has been a year of disillusionment for mobile TV with crumbling adoption rates and most users watching it for free, the football World Cup in 2010 offers the opportunity to energize the market. Whether this sudden rush of demand can be sustained beyond the tournament remains to be seen.

Globally, the number of mobile TV subscribers is set to double in the next three years and will reach 230 million by the end of 2013 generating €1.7bn. With a mobile population of over 1.5 billion users by the end of 2013, China and India are set to generate more revenue from mobile TV services than Europe and North America combined.

Ronan de Renesse, Senior Analyst says: "Companies such as Apple and Google have brought a much needed breath of fresh air to the mobile content industry by opening up the ecosystem, providing flexibility to developers and content providers, driving innovation and increasing consumer awareness. Whilst 2009 proved that there is strong demand for mobile content, 2010 will be much more about how to sustain usage. Falling prices combined with exponential mobile data growth will threaten the profitability of stand-alone mobile content services and data access. The successes of 2009 could become the nightmares of 2010."

Story filed 21.12.09