Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

REPORT: ESCA Europe - Supplying content in an uncertain marketplace

ESCA Europe 2009 in London treated the 200-plus delegates to a profusion of topics – from progress reports on authoring, production marketing and distribution of Blu-ray discs and BD-Live advances to supply chain efficiency, environmental strategies, online distribution, wholesale and retailing, manufacturing-on-demand, kiosks, gaming and piracy issues. JEAN-LUC RENAUD highlights the fresh takes that caught his attention.

BD-Live was, finally, thoughtfully discussed, with challenges, opportunities, but also no-go areas. Usage figures helped point to where BD-Live is going in the US where it has a head start, complete with a live (European) demonstration. The packaged media-vs.-online debate was given a refreshing take with a look at the problematic monetization models of online content delivery and why it is not about to wipe out the good old packaged media. Certainly an eye-opener was the successful anti-piracy measures implemented in Sweden.

Blu-ray - Quo Vadis?

As expected, Blu-ray took central stage with an awkward mix of chest-beating satisfaction at the road travelled so far and not so veiled concerns that considerably more should be done to spread the BD word if the mass market is to turn Blu.

The good news is that the economic crisis does not seem to dent consumer enthusiasm for high definition, helped by a sharp fall in both hardware a software prices. Futuresource expects sub-€100 Blu-ray players to be on the pre-Christmas shelves. An ever wider range of brands are currently available, starting at €200 for a BD 2.0 player (even €150 in Germany). First-generation BD 1.0 players can be had in the UK for £79!

Some 31 million BD movies will have been sold in Europe this year – a three-fold increase over 2008. The predicted figure for 2013 is 300 million discs, the year Blu-ray will overtake DVD in consumer spending.

As to the price premium of a BD title over its DVD version, Futuresource calculated it fell from 100-150% to 35-50% over the past 12 months for new releases. The picture is less encouraging for catalogue titles where the price differential is still 100-150%, though it was 250-300% last year. Some 1,500 BD titles are already on offer.

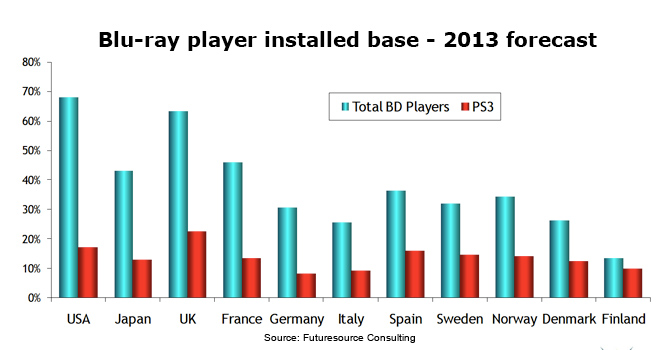

While PS3 is still the key playback device this year, the installed base of standalone Blu-ray players will have grown “impressively” by 2013, accounting for two to three times the PS3 population, a critical growth engine because of the much higher tie-rate of BD titles per player.

A whopping 83% of Europeans are now aware of Blu-ray, rejoices Yves Caillaud, Senior VP of Warner Home Video & Digital Distribution, EMEA, and Chairman for the Digital Entertainment Group Europe. The challenge is to turn awareness into a purchasing decision. “We have not done enough of that,” he says. “We need to work harder with retailers to ensure we communicate a consistent message, that the best way to watch movies at home is with Blu-ray. We need to set up proper in-store presentation booths. Side-by-side demos in the US increased consumer interest in purchasing BD from 31% to 48%. Essentially, we need to give retailers more confidence in the future of the BD format.”

A lot of work remains to be done. Lindsay Brown, MD of International Operations at Eagle Rock Entertainment, notes that there is still a lot of confusion amongst consumers as to whether BD players can play CDs as well as DVDs. “That message has to get across: the machine is fully backward compatible. Even sales reps need to be educated. That’s the key message missing so far. We need to get the basics communicated first before moving to BD-Live and 3D.”

While conference organisers and key sponsors were keen to whip Blu-ray up, the assembled wholesalers and retailers reminded – some apologetically – that DVD is still a big – very big – business that pays the bills.

Indeed, Rob Slater, Category Director for Entertainment at Tesco’s – the UK’s number 1 supermarket chain – raised the fundamental issue of what is the Blu-ray value proposition the industry is putting before the consumers. “Blu-ray is an answer to a question nobody asks. Nobody complains about their DVD experience. Hardware and software are inexpensive, there is depth and breadth of content, and the system works perfectly. BD may be better, but it does not replace a product perceived to be inferior.”

“Most households have more than one DVD player. Family members do not watch the same programme at the same time. They are moving content around the house. With a single BD player, this flexibility and convenience no longer exists,” adds the Tesco executive.

Photos courtesy of Heiko Meyer/Entertainment Media Verlag

Slater believes the industry is at a crossroad. “We are unclear what we are selling to the customers. We cannot keep selling the same thing over and over again. Selling VHS, then DVD, then Blu-ray, then digital copy is over. We have to make a critical decision whether to sell customers a copy or a licence to the content.” He welcomes studios that are embracing the combo DVD+BD+digital concept. “To buy content in multiple formats in one box at one reasonable price is the promising way to go.”

BD manufacturing - latest

In line with any other sector of the packaged media, the price of BD manufacturing tools is coming down. And it must if manufacturing costs are to come down and contribute to a leaner supply chain that will bring Blu-ray to a price point that turns consumer interest into consumer adoption.

Dieter Daum, CEO of Sony DADC, points out that the productivity of BD replication has already more than doubled over the last two years. A BD50 line cost $3.5m in 2007. This year it is $2m. The line capacity has increased from 3.5 million discs per year two year ago to 5 million today. “The challenge is to bring the cost down.”

We also learnt that is takes about a 12-week lead time to get a new BD line up and running, for those already in the know. For newcomers, six months are necessary as the learning curve is “pretty long.”

No figure about the all-important BD50 yield was revealed, beside the laconic “yield must improve,” “yield is OK for now.” Coming from the largest replicators – Sony DADC, Technicolor, arvato, Cinram – it is obviously still a challenging proposition.

Unavoidable Sony was asked how independents could do business when DADC control 90% of the market? “This figure is wrong,” answered Daum. “Everybody is welcome to make the investment, everybody is welcome to go after the same customers. I am absolutely convinced that our market share reflect the level of investment we put in.”

BD-Live inroads

There is now enough usage data for BD-Live in the US to start talking intelligently about what works and what doesn’t. “BD-Live is first and foremost a movie-watching experience,” says Russell Stewart, Director of Product Development at Sony DADC. “The BD player is not a computer, a phone or a game console. BD-Live does not lend it to chat, nobody wants to chat, the data are pretty dismal. Watching a movie is a fundamentally different experience than everything else.”

Todd Collart, Senior VP New Media at Deluxe Digital Studios, agrees. “Chat inherently requires a live experience which cannot truly be accommodated with watching movies. Perhaps it could be akin to a Facebook experience.”

Another conclusion: “Bury complexity. Don’t treat BD-Live like it is the web. If you can do that you are probably going into the wrong direction in terms of design,” argues Stewart. “BD-Live is a technology, not an application,” Collart adds. “It must become an experience that engages the consumer, if not it will not take up. It should be transparent to the users, not aware of it. BD-Live should be a call to action rather than testing the features themselves,”

Collart has solid aggregated data from several major studios at his disposal – 30 million disc inserts in less than one year representing 5 million unique players. Some four million disc inserts a month are being tracked. The US accounts for 65% of volume usage, Europe 30%, and Asia 5%. Player usage is still heavily skewed towards PS3 consoles (82.5%) compared to standalone BD player (17.5%), but the balance is shifting fast. The company uses 1,200 servers worldwide, as servers must be at close proximity to the users for seamless streaming.

Stewart, for his part, relies on Sony Pictures data – 6 million BD-Live users so far, with 100,000 weekly visitors.

BD-Live is often heralded as the killer app for commerce, collecting consumer data for targeted messages. But both speakers are cautious. “BD-Live may become an important platform to get lead generation, but the path to monetisation must start with educating the consumers about what the experience is,” says Collart. “BD-Live could eventually pay for itself, but not yet. We need to experiment with commerce to discover what the consumers want, at what time they want it, and what is the triggers that turn consumer use into a transaction.”

However, maintaining a server with refreshed, original live content for the life of each BD-Live-enabled titles is not for the faint-hearted, and is essentially the preserve of the big studios, that can afford it. Or is it?

In a web-connected, live, smooth-running demonstration, Andreas Thran, CEO of German BD pioneer Imagion, unveiled an ‘out-of-the-box’ BD-Live content management solution – dynamicHD – affordable to smaller, independent publishers. “For BD-Live to succeed requires adoption by smaller content publishers,” says Thran. “For €2,000 per year per title, we offer BD-Live client implementation + basic packaged (trailers, banners, texts, pictures, etc), Web-hosting and access to content management, content delivery through the worldwide Akamai network and bootstrapping.”

Photos courtesy of Heiko Meyer/Entertainment Media Verlag

Whether publishers are anxious to embrace BD-Live is another matter. For Lesley Johnson, Head of Production at 2 entertain (distributor of BBC content), that operates on tight timeline, the focus is first and foremost on the quality of audio and video assets, not on BD-Live. “We have not pushed the [BD] format to its limit. We want to put a perfect product on the market that consumers can buy and play without technical problem. We want to keep it simple.”

Same echoes from Julian Day, Director of Digital Services at Muse (formerly DGP), “Picture quality is the priority, BD-Live will come later.” “Making product that work across various devices is more important than experimenting with advanced features,” says Chris Skarratt, MD of Petrol Digital. “BD-Live is too young in the UK market. Clients are very reticent. They want a product that works the first time.”

Going green

Discussion of “green” issues, ordinarily an important feature of a supply chain conference, was a relatively small affair this year, testimony to the fact that in a tough economic climate, staying in business takes precedent over turning the business green, whatever the long-term merits.

It would have been interesting to discuss environmentally friendlier, thinner discs that start to appear under various names. Surely, cutting the amount of polycarbonate by half would go a long way to save the planet. However, panel moderator Amy Jo Smith, Executive Director of the Digital Entertainment Group, made sure the topic was off limit. “We believe we should not do anything that impact on the integrity of the DVD disc as defined under DVD Forum rules. I assume you have the same approach and restrictions here in Europe. There are playability issues, we don’t want to temper with it.”

My neighbour was taken aback. "Is sticking to 15-year old modus operandi of an organisation that has reached its sell-by date more important than securing a healthy future for my grandchildren? This so-called playability issue is a canard."

Entertainment - the global picture

While European consumer expenditure on entertainment is a big, and growing, business – $87.1bn in 2008, forecast to hit $99.8bn by 2013 – for packaged media, “flat is the new growth in today’s climate,” says Alison Casey, Head of Global Content at Futuresource Consulting.

The average European TV household will be spending $493 this year rising to $570 by 2013 across all sectors. The largest amount is earmarked for Pay/Subscription TV – $228 heading for $275.

Box office is holding its own, accounting for $47 and increasing to $53 over the 4-year period, pushed up by 3D cinema. Same picture with packaged games where consumer will disburse $68 this year and $75 in 2013.

Though packaged music (CDs) keeps falling – $47 to $23 – packaged video is not yet following suite thanks to Blu-ray, with household spending going from $68 this year to $60 in 2013.

Admittedly starting from a low base ($16), online content will more than treble ($54). As for mobile content, spending will double from $16 to $30.

“Though going down, revenues generated by consumers buying music, video, games on disc are very healthy. Consumer behaviour is not going to change radically. Just because online access is available does not mean a big consumption shift,” says Casey.

The problem with online is that online 1% of online content is paid for – “a frightening prospect which can hardly be reversed,” adds Casey. “Packaged media is a form people are used to pay for, despite piracy. But people are not used to paying for online content.”

This year in Europe, 170 billion videos will be viewed, half of that viewed on YouTube, predominantly user-generated content (UGC). Long-form movies account for a tiny proportion – 3.5% of all content or 6 billion screenings. To make matters worse, only 1% of that, or 34 million (including online VOD and EST), is paid for. Free catch-up TV (BBC iPlayer), cable/IPTV/VOD, and illicit file-sharing account for the lion’s share.

Digital supply chain – the challenges

Tom Moran, Senior Director of Media and Entertainment Markets at Savvis, spelt out what the digital supply chain is, and how it differs from packaged media.

“Packaged goods make money. Some digital goods make money, but only for a few people. Packaged media is based on standards whereas the digital goods marketplace is about serving an ever-growing number of disparate formats. Critically, the auditing of physical media sales is comprehensive, digital supply chain auditing is non-existent,” notes Moran.

When it comes to revenue models, the only model that has worked so far is turnkey solutions from CE companies. The current market favours the “walled gardens” as opposed to “shared services” and infrastructure. CE companies develop their own format locking consumers into proprietary formats (xBox, Wii, PS3), and their use of DRM.

On the pipeline front, telco infrastructures are patently insufficient to support long-term video delivery projections.

The challenge is on the legal front as well. There are licensing issues. Unfavorable licensing terms hurt digital content delivery start-ups. “Video and movie studios are risking a Napster replay,” warns Moran.

With current patterns of digital delivery development, there is a fundamental cultural shift away from respect for Intellectual Property laws that could have significant long-term consequences. The so-called “net neutrality” laws could weaken the business foundation.

Predicting what takes place in the digital space is an impossible exercise. “The ring tone market is considerably more lucrative than music, something music executives never predicated. iPod never registered in charts before they appeared. Neither did Napster,” mulled Moran.

Moran concludes that the packaged media companies still have an opportunity and an incumbent position. Content owners like the old model, “maybe too much.” Essentially, consumers want convenience. At the end of the day margins are everything.

Photos courtesy of Heiko Meyer/Entertainment Media Verlag

Piracy – fighting back

On the piracy and counterfeit front, an eye-opener were the successful anti-piracy measures implemented in Sweden, set in motion by Gerre Versteegh, Chairman of the Board of Bonver. At a time when the UK and France are examining or adopting legislation to cut the internet connection of serials illegal downloaders, delegates were given a sense that combating pirates is worth fighting for and indeed can show results.

Versteegh brought all content owners together, not just video and film producers and distributors, but also music and book publishers as well as journalists, writers, and actors union – 40 organisations to date. “Swedish politicians could not care less when you talk to them about movie piracy. It’s something else when you talk about books.”

“IP protection is a freedom of speech issue,” contends Versteegh. Now Sweden has established a special prosecutor, a special police unit educated on piracy/IP matters, and the crowing achievement since April: an enforcement directive.

“As soon as the law came into effect, the illicit internet traffic went down 40%. Music sales are up 74%. Online retailers’ trade is up 100%. Business through our 1,500 video stores went up. Consumers who may not have given much thoughts about downloading illegal content, are now back in the store to rent and buy again,” says the jubilant Bonver executive. “The whole society is standing up. The message is now clear from consumers to politicians: piracy is illegal, full stop, no more discussion.”

Story filed 05.10.09