Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

Striving US online video services to reach $1.45bn by 2013

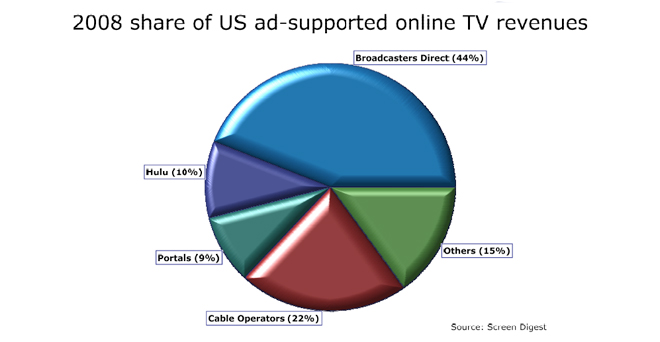

The Internet-based TV services of the four major US TV networks – ABC Full Episode Player, CBS Audience Network, NBC.com and Fox.com – together with Hulu, the joint venture between NBC Universal, News Corporation and Disney, accounted for a combined 53% of an ad-supported US online TV market that generated $448m in revenues in 2008, according to Screen Digest’s latest report.

The remaining share of revenues was made up of the online video services of major sports leagues, video services from traditional online portals, and direct services from other major channel groups and content owners.

Screen Digest goes on to state that the combined dominance of the leading broadcaster-supported platforms will drive the total ad-supported model for the distribution of online entertainment programming, news, sports and events in the US to more than $1.45bn in revenues by 2013.

In contrast, third party platforms such as YouTube, Joost and other portals, which have no direct vertical affiliation with major rights holders, nor direct access to premium content rights, will struggle to aggregate ad-supported movies and TV shows.

The Hollywood studios and major rights holders will continue to limit such deals, instead preferring to build their own syndicated ad-supported online video services – such as Crackle, developed by Sony Pictures, and the CBS Audience Network. This is a trend that will gather momentum.

As a result, third party ad-supported video platforms may have to either diversify into new forms of their own original programming, exit the content aggregation business and offer technology and advertising solutions to the content-owners' and broadcasters' own services, or settle on the low-margin business of becoming affiliates of the player-platforms distributed by the content rights holders themselves.

Indeeed, Joost, the much-hyped online video provider, is dropping its consumer proposition and reinventing as a "cost-effective" white-label video provider. Along the way it is cutting many staff possibly preparing for a sale as a technology company rather than an entertainment platform. The company was founded in 2007 by Janus Friis and Niklas Zennstroem, the founders of Skype and Kazaa. Joost has raised upwards of $50 million in funding.

According to Arash Amel, author of the report, "With better targeting and increased ad inventory, online TV services could be generating per-viewer revenues comparable to an average TV broadcast viewing in as little as three years. However, based on the current online ad strategies implemented, it will account for 2.2 percent of all US TV advertising revenue by 2013, but definitely won't be generating enough to offset the $2bn we expect total US TV advertising to have declined by during in that period."

In a trend being replicated across the globe, the major US broadcasters are evolving into multi-platform TV distribution networks in a land-grab attempt to replicate their traditional channels business online – both linear and on-demand. There is now a proven ability to drive audiences to online TV replay services from primetime schedules, accounting for the market dominance of the networks' online TV services.

Screen Digest’s report goes on to state that free online TV will challenge the paid model of TV download services such as Apple's iTunes, and pay-per-view and subscription online sports video offerings, and will require innovation from these service providers to remain competitive. But that the paid market, driven by the respective hardware ecosystems of the leading service providers, and high value sports events, will remain robust – growing by 67% to $1.33bn by 2013.

Story filed 06.07.09