Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

More Blu-ray Disc replication lines needed to meet European demand

In its latest report on the subject, London-based analyst Screen Digest estimates that European consumers bought 37.8m Blu-ray Discs in 2008. In 2009 this figure is set to more than double to 85.7m discs, driven by rising BD hardware penetration. But the analyst warned that more BD replication lines will be needed if demand is to be met.

These figures include both video and PS3 games titles and reflect stock-keeping units (SKU), which means that some titles would have include more than one disc – a significant factor in terms of replication requirements and capacity, compared with sales unit figures.

Screen Digest expects the balance of BD software replication to shift away from BD games towards video titles. In 2008, games accounted for 72% of consumer BD transactions. In 2009, despite a forecast 35% increase in games sales volume, their share will fall to 43%.

“The trend will also affect the types of discs being replicated,” explains Senior Analyst Richard Cooper. “Whilst almost all BD games are manufactured on single-layer 25 GB discs (BD25), our research shows that last year over 60% of video titles required the larger BD50 discs. Furthermore, once the burgeoning BD rental market and supply-chain pipeline fill have been factored in, our analysis indicates the European BD sector will have to replicate 110m discs.”

Screen Digest warns that, if running all year at maximum capacity, Europe’s BD replication lines installed during 2008 could just be sufficient to meet 2009 manufacturing requirements assuming no additional investment. “Indeed, with the additional capacity afforded by Cinram's out-of-territory BD replication for Universal, available capacity has the potential to exceed immediate requirements,” Cooper points out.

However, the DVD business is seasonal – a third of lines are idle though much of the year, even allowing for non-seasonal business-to-business replication. “For BD this trend will be exaggerated in the early years, as each month increases the size of the addressable hardware base,” says Cooper. “In 2008 an estimated 25% of European consumer BD sales occurred in the first half of the year; 60% in the final quarter. We expect a similar scenario in 2009 and anecdotal evidence already suggests that first quarter 2009 replication capacity was far from fully utilised.”

Screen Digest research indicates that in addition to the 59 mixed BD25 and BD50 lines available at the time of writing, a minimum of 18 further lines will need to be made operational by the second half of 2009 to meet forecast European consumer demand. The analyst reckons that both Sony DADC and Technicolor increased their European BD capacity significantly in 2008, from 11 and one line respectively at the beginning of the year to over 40 and four by the fourth quarter. Meanwhile, five independent replicators secured BD licences.

Progenitor of the format, Sony DADC has the lion’s share of the BD replication business – about 75%. It also manufactures its own replication lines which should help the company maintain it dominant market position. Screen Digest points out it will become increasingly difficult for the Anif, Austria-based plant alone to keep place with the forecast leap in fourth quarter demand, warning that if demand for BD is to be met other replicators must continue to invest speculatively in BD, despite the economic climate.

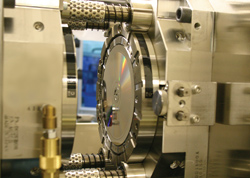

“Unlike DVD, where second-hand machines are readily ¬– and rapidly – available, companies planning to invest in BD lines this year have no time to lose,” concludes Cooper. “Orders from Singulus Technology, the largest BD line manufacturer apart from Sony, carry a 10-12 week lead time. Unless this situation changes, only orders being placed now are likely to be operational by the beginning of second half 2009.”

Story filed 22.03.09