Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

ANALYSIS: Breaking barriers - what does television mean today?

The internet continues to disrupt the world of video and television, and its impact is now permeating all corners of the value chain. Viewers are watching video and TV on a growing range of devices. Content producers are findings new routes to market via online services. Given all these changes it is inevitable that we begin to question the very terms which define the industry, says DAVID MERCER, Principal Analyst at Strategy Analytics.

Online video 'rental' services such as Netflix and Lovefilm are now used by tens of millions of customers. Pay television and other broadcasters are extending their offerings beyond the traditional set-top box to reach customers using over-the-top services. As I noted a year ago, the lines between pay television services and video continue to dissolve.

Having started life as a DVD distributor, Netflix is now a key player in the 'television' market, at least in the sense of producing and delivering TV-like content which can be watched by TV viewers on large screen TV displays. Netflix takes great pains to position itself in contrast to pay TV or 'generic video' companies, as it describes players like Comcast and Sky. It sees itself as a 'movie and TV series network' whose USP is the simplicity of its user experience and customer relationships.

This description might make us wonder whether this 'network' will end up forging similar relationships as the traditional TV networks (ie TV channels and broadcasters) with TV service providers and pay TV companies.

While disruption from new players continues, the established market leader Sky is now promoting the UK's biggest catchup TV service, which includes access to full box sets of TV series and hundreds of movies on demand, accessible to viewers via big screen TVs as well as PCs and many mobile devices. Sky Movies on demand are also available to subscribers to its Now TV service, its OTT (over-the-top) service which had just been launched when I wrote last year's article. Sky has now added live sports and has also introduced a standalone Now TV box which retails for £9.99 to allow anyone with an HDMI-enabled TV set (which are the vast majority in use) to get this 'smart TV' functionality.

The other recent development of note is Google's launch, in the US only at this stage, of Chromecast, another TV adaptor which connects to the internet to play video from built-in apps (Youtube and Netflix included, of course), as well as from a Chrome browser. At the $35 price point Chromecast is positioned as a no-brainer for anyone who wants to watch internet video on the TV screen rather than their PC, smartphone or tablet. It has its usability weaknesses, notably the fact that it requires a separate power lead running either to a power socket or a USB port on the TV itself, but Chromecast appears to have established a new value proposition the rest of the OTT video industry will be unable to ignore.

Over the past year and in response to the OTT threat, TV Everywhere services from traditional pay TV providers have continued to proliferate to the extent that no major pay TV provider, whether cable, satellite or IPTV, is now without some form of TV Everywhere offer in its line-up. The content available within these services still varies greatly in terms of the range of the mix of live, catchup and VOD material available, but the goal of pay TV providers is clear: to offer as much content on as many screens as possible as rights agreements allow.

So even in the space of a year the TV/video industry continues to evolve rapidly, and customers have more choice than ever before in terms of the range of programming available and the places they can go to find that programming. How much impact has this had on the viewer population as a whole?

Internet TV is growing

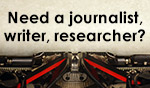

One piece of evidence comes from our recent ConsumerMetrix survey, which found that usage of internet TV services has increased by 20% during the past two quarters, ie between Q4 2012 and Q2 2013. By 'internet TV' we refer to people who have watched either TV or movies over any internet-based service, including streaming and download, paid-for and free services.

The highest levels of usage are still in the US, where nearly a third of people now use these services at least monthly. Growth was also seen in each European country, although in Germany usage is now markedly lower than in the other three major European markets.

This data suggests that the internet TV and video market continues to grow rapidly and is well into the mass market phase of its development. As adoption of connected video devices continues to grow and as the range of services and content expands we would expect this usage to reach levels of 80-90% of the population over the coming years.

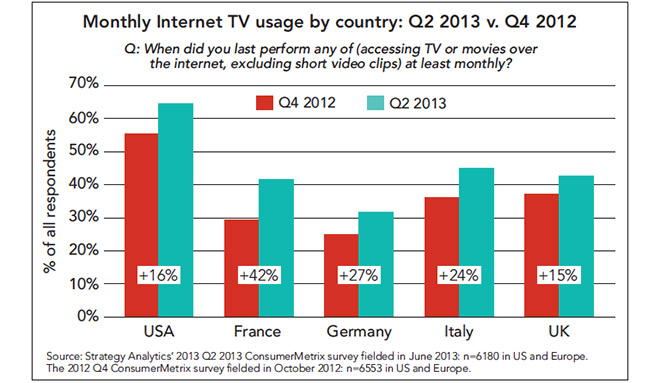

As noted above the other major trend has been towards usage of different screens for watching TV shows and movies. Computers are still the most popular screen, and in fact usage of all major screens has increased across the population over the last three years. It is noticeable that in our latest survey people were as likely to use a TV screen to watch internet TV as a portable computer (although usage of computers overall, including desktops, is higher than TV).

Not surprisingly the fastest growth in recent years has been in portable smart devices: since 2011 the proportion of people using a smartphone for internet TV has risen by nearly 8% and those using a tablet by more than 10%.

The arrival of the tablet has created a great deal of excitement around video and TV usage and it is truly a disruptive technology in that it is hard to categorise in terms of traditional segmentation. Many people describe the tablet as a mobile device, but the reality is that 80-90% of tablet usage happens in the home, and only a small minority of tablet users make use of wireless (ie cellular) network connectivity. As our data shows, the tablet is clearly becoming a popular device for consuming video content, and when we consider that tablets are still only used a third of the population, there is plenty more growth left in this market.

As an indicator of where the future may lead us, when we identify today's 'tablet addicts' - people who use a tablet daily - they are now choosing the tablet as the preferred device, ahead of PCs, TVs and smartphones, for watching internet-based TV or video content. Some observers are saying that the tablet is going to usurp the TV screen itself for the majority of TV viewing before long. We are more positive about the long-term survival of the big screen, but it is clear that its role is increasingly being called into question.

Smart TV

Connected or smart TV has now been around long enough to examine how behaviour and attitudes have changed over the last few years. We recently published an ethnographic study which revisited eight early adopters who were ?already using connected TV systems in 2010.

Over the past three years, half of these people have since acquired a smart TV, and while they appreciate the convenience of the integrated smart TV technology, there was a general feeling of disappointment with smart TV apps and services available. People tend to note that the capabilities and functionalities of smart TVs are a long way behind those of smartphones and tablets, going as far as describing many smart TV apps as useless.

There are a couple of positive findings from this research: the first is that the one thing people do value from smart TVs is media- and video-related apps and services such as Netflix and BBC iPlayer. And the other is that people still place a high value on video quality. A number of respondents reported that they did not use the smart TV as their main TV set because its quality was not as good as their regular TV.

We also found clear evidence of the impact of multiscreen video. Respondents noted that since the arrival of internet TV and video services on PCs, tablets and smartphones, there has been a trend towards fragmented viewing behaviour and away from collective viewing in front of the big screen.

On the other hand, when video is viewed on the TV screen people are increasingly using 'second screen' devices at the same time. At the moment the apps on those devices are rarely coordinated or synchronised with the TV screen content, although the activity (such as social networking) is often related to it.

Running the numbers

So, what does all of this mean for markets and revenues? In 2013, we estimate that global revenues from subscription VOD OTT services will reach nearly $4.5bn, an annual increase of 40%. A huge 95% of this market is accounted for by 'new' players like Netflix and Amazon/Lovefilm. The remaining 5% we describe as TV SVOD (Subscription VOD), which refers less to the nature of the content than the origins of the services; in other words TV SVOD services are OTT services provided by traditional 'managed' pay TV providers like Sky and Cox (Sky's Now TV service would be an example).

These services are clearly in their infancy, but we believe they are going to provide much of the growth for the OTT TV/video market over the next few years as pay TV providers seek to counter the competitive threat from new players as well as use the internet to reach so far untapped audiences.

By 2018, we forecast that the total OTT Subscription VOD market will reach global revenues of $10.1bn, and nearly half of this will be accounted for by 'pay TV providers.' Significantly, at this time we are projecting that the revenues for 'new' players (who will not be so new by that time) will have begun to decline. In the end we believe that the power of pay TV to combine and market multi-use content rights across multiple devices, including the TV itself, is likely to prove critical, although there is still likely to be a role to play for new competitors in some specific markets or segments.

What it means for packaged media

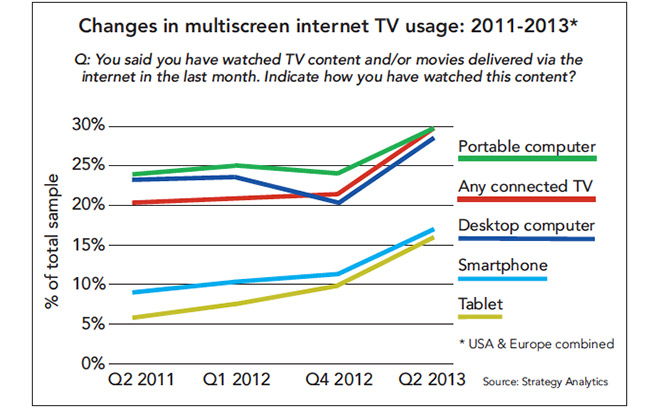

There is a common assumption that all of this online video activity must have negatively affected the disc business. While revenues have clearly been in decline, our survey data tends to suggest that there is another side to the story. When we compare survey findings from 2010 with recent results we actually find that a higher proportion of people now either purchase or rent a DVD or a Blu-ray Disc than they did three years ago: 45% of respondents across the US and Europe in 2013 compared to 39% in 2010.

This growth has been driven by disc purchase, while rental has declined. More than a third of people claim to have bought a DVD in the past month this year, compared to just over 20% in 2010. Growth in BD purchase activity has been lower, and while this is disappointing given that BD is the emerging format, this perhaps confirms that the growth has been driven by heavy discounting on DVDs while BD prices remain relatively high.

It is disc rental that has clearly been affected by the growth in alternatives: rental of both DVDs and BDs has declined over the past three years although some people outside of the disc industry might be surprised that this is still as high as it is. If we looked into the regional data we would see that the US is still by far the most active packaged video market, and both purchase and rental are still holding up relatively well here. In Europe, activity levels have always been lower than in the US ?although the sell-through activity has still ?increased in each country.

In conclusion, it seems clear that consumers will continue to use more and more ways of watching video and TV content and for the next few years at least the story will be one of choice proliferation. Some might prefer to call it chaos, and it certainly won't be a time for faint hearts. Survivors will need to demonstrate extreme levels of flexibility and awareness in order to ride the various waves of opportunity that lie ahead.

DAVID MERCER is Vice President, Principal Analyst of the Digital Consumer Practice at Strategy Analytics. He has 20 years experience in analysing and consulting within the digital consumer broadband and media industries. David has worked with major global players across the value chain. Contact: www.strategyanalytics.com.

Story filed 10.12.13