Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

FEATURE: European video market - resilient packaged media

Europeans are increasingly opting to view movies and TV shows via digital platforms, but the market for DVDs and Blu-ray Discs is still by far the much larger market in terms of consumer spending and transactional consumption, says TONY GUNNARSSON, Analyst with IHS Screen Digest. The new norm in European video is hybrid consumption with viewing being shared across multiple formats and platforms.

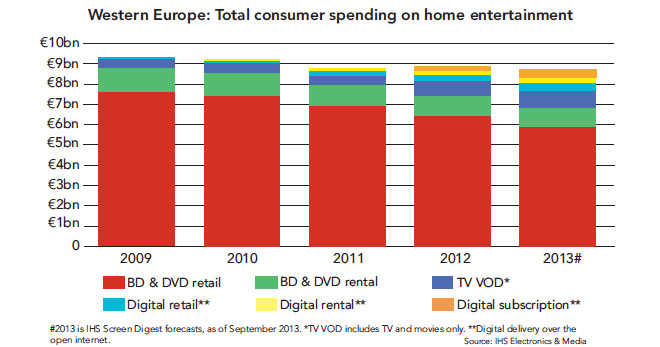

In 2012, Western Europeans spent some €8.65 billion watching video on physical discs and on digital platforms, a decline of just 1.4% over 2011. The latest available data from the three biggest European markets (Germany, France and the UK) indicate that 2013 is likely to be a stable year, with only a marginal decline in spending of just 0.7% over 2012.

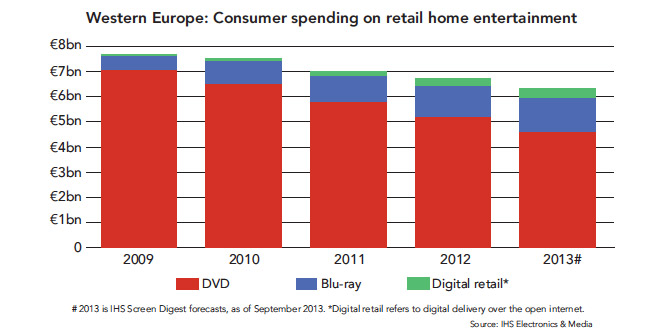

DVD spending and consumption is in decline, while at the same time, growth for Blu-ray Discs is now starting to slow down. In 2012, spending on buying and renting DVDs totalled €5.96 billion, dropping 11.6% compared to 2011, with Europeans spending €1.37 billion buying and renting video on the BD format, a year-on-year increase of 17.4%. While total consumer spending on physical discs is in decline, DVDs and Blu-ray Discs continue to be by far the largest generator of spending in the European video market - last year representing a 85% share of total consumer spending on video across all platforms.

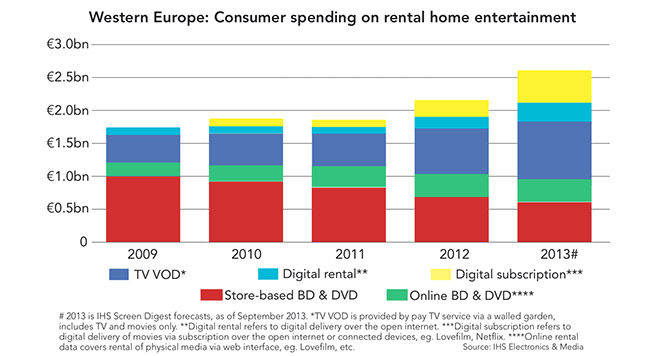

But digital video - which includes both paid-for movie and TV content consumed over the open internet (OTT) and via Pay TV on-demand services - continues to grow rapidly. Last year, Europeans spent €1.32 billion across all internet-based and TV-based digital video platforms, an increase of 51.5% over 2011.

The largest category of spending within transactional digital video is pay TV video-on-demand (TV TVOD), which increased over last year by 24.0% to generate €660 million. At €270 million in spending in 2012, OTT digital retail - or what is also often referred to as electronic sell-through (EST) - was still the largest sector, followed by OTT digital rental at €198 million.

However, the fastest growing business model is digital subscription, which more than tripled in size to €193 million in spending over 2012. This remarkable growth is the result of US-based online rent-by-mail and streaming pioneer Netflix launching its online movie and TV services in the UK, Ireland, Sweden, Norway and Denmark in late 2011 during 2012. This rapid growth in spending means that in 2013 digital subscription will become the largest of the three OTT or internet-based video distribution channels, overtaking both digital retail and rental.

The growth in European digital video is very impressive, but the sheer scale of DVD retail and rental consumption - responsible for 69% of the Western European video market last year - means that even in decline, the physical format will still be important for years to come. The European market for BD still continues to be larger than that for transactional TV-based VOD - and bigger than all transactional and subscription OTT video delivery platforms combined. But with European video retailers in crisis and generalist rentailers continuing to cut back on the shelf space dedicated to physical discs, the transition to consuming more video on digital platforms will accelerate in the next few years.

The European video retailer environment is changing

The first half of 2013 has been marked by several high profile video specialist retailers experiencing difficulties in a number of markets across Europe. Some closed their retail operations entirely, such as Virgin in France. Others, such as HMV in the UK, Ex Libris in Switzerland, FNAC in Italy and the Free Record Shop in The Netherlands, remained open, but reduced in both number of storefronts and in the depth of physical media they offer to consumers.

The impact of video store closures on the physical video retail market is clear - the removal of the opportunity for consumers to purchase video products in store will result in lower sales volumes. Some physical video purchases are likely to be picked-up elsewhere, via online retailers or in supermarkets; but the trend in entertainment specialist closures across Europe is, in effect, a forced change in consumer behaviour that is having a direct impact on the sales of physical video.

The number of retail outlets selling physical video product in the UK has actually increased in recent years. However, this is only the result of major supermarket chains opening smaller convenience food stores, sometimes stocking a small section of new release video titles. However, the reality is that the overall availability of video product has fallen drastically in recent years. Video specialists and other stores which previously carried a full range video product in the UK have either closed or reduced both store numbers and the amount of shelf-space given over to physical discs. In January 2013, both HMV and Blockbuster UK, the British rental store market leader, went into administration. Both companies have since been acquired by restructuring specialists Hilco and Gordon Brothers respectively.

According to UK Official Charts Company, published by the British Video Association, consumer spending on physical video grew to £633 million in the first six months of 2013, an increase of almost 3% compared to the same period in 2012. A substantial upturn in the growth rate for consumer spending on BD is partly behind the positive results, having increased by 37% over the first half of 2012 to £117 million. The UK video market also experienced a smaller rate of decline in spending on DVD compared to previous half-years, down just 3% to £515 million.

According to IHS analysis, these positive first-half results for the UK are largely the result of the well-managed store closure programme executed by HMV - one that resulted in ownership closing nearly half of all its UK stores. The crisis for HMV received high-profile media coverage and British consumers rushed to stores to take advantage of the expected lower pricing resulting from the bankruptcy. However, consumers were instead presented with moderately priced promotional product rather than fire sale prices. But, the reported figures suggest that consumers were far from disappointed, instead purchasing a substantial portion of HMV's legacy stock.

HMV is one of the last few bricks-and?mortar specialist retailers left in the UK where consumers can explore a full range of BD titles, and HMV used the increase in footfall as an opportunity to sell BDs to consumers at current market prices. Consumers keen to purchase BDs whilst the opportunity remained received a swift re-education in BD pricing.

The resulting radical change in consumer price perception around the format drove growth in sales during the first three months of the year. The HMV stores earmarked for closure remained open throughout Q1, running the closing sale continually. It was only after the final closure of such stores at the beginning of the second quarter that sales of both DVDs and BDs begun to wane.

Therefore, despite the positive first half, IHS has forecast a decline for the remainder of the year, when the market is expected to reflect the extent of HMV's store closures, in addition to the self-space reductions for physical video evident in many of the UK's supermarkets. In 2013, the UK's physical video market is likely to decline by 11.6% in terms of value to around €1.9 billion.

Like the UK, first-half of the year in France was characterised by retailer contraction, notably the bankruptcy of Virgin France. Virgin megastores in France also declared insolvency in January 2013, which will result in the closure of all 26 of its stores in France. But unlike the UK, the French market has long been dominated by hypermarkets and entertainment generalists such as FNAC. The closure of Virgin France undoubtedly affected first-half performance of physical video, but it is unlikely to impact greatly on the full-year results.

In France, first-half of 2013 figures from the Centre National de la Cinématographie indicate that total spending on physical discs generated €440 million in the first six months of 2013, down 12.5% on the same period in 2012. According to IHS forecasts, the French home video market is expected to decline by 7% in value this year, performing marginally better than in 2011 and 2012.

In Germany, first-half of 2013 video numbers reported by the German video body the Bundesverband Audiovisuelle Medien (BVV) reveal remarkably that the German market is currently experiencing growth in physical video, a trend that is counter to the broader European trend of decline. In the first six month of the year Germans spent €798 million buying and renting DVDs and BDs, in what the BVV announced is the best first half for physical video in Germany since 2005.

Both physical video retail and rental consumer spending increased over half-year 2013, by 12.6% to €650 million and by 9% to €147 million respectively. German consumer spending on DVD retail increased by 3% to €437 million, while BD sales increased by 41% to €188 million. The unusual growth in a physical video market as demonstrated in Germany in the first half of 2013 is driven by strong German adoption of BD. The German BD success is demonstrated both on the hardware and software side - this year Germany will overtake the UK as the largest installed base for BD hardware in Western Europe. On the software side, BD now generates more than a quarter of all video unit sales ? the highest BD conversion rate in Europe.

MediaMarkt, the consumer electronics store chain, has so far in 2013 been very aggressive in its in-store promotion of physical video, after having reduced promotion in 2012. In 2013, both DVD and BD sales have benefitted from pro-active promotional efforts on the part of retailers. In IHS analysis, this year the German video market is headed towards overall growth with consumers spending €1.7 billion on physical video, an increase of 6% over 2012.

Industry threatened by the reduction of shelf-space dedicated to DVDs

A less obvious threat to the future of the home video in Europe is coming from the industry's remaining generalist and supermarket retail partners. As a result of the crisis for video specialists and home entertainment retailers across Europe, studios and video distributors are increasingly finding themselves dependent on bricks-and-mortar supermarket and generalist retailers - as well as online retailers - for direct access to consumers.

Since the physical video market peaked in 2004, keen price competition between retailers (especially those using new-release video to draw consumers into their stores) has significantly reduced the profitability of the new release DVDs and BDs overall. With reductions in profit, general retailers, such as supermarkets or department stores, are finding stocking home video a less attractive option. As a result, these retailers are reducing shelf-space given to physical video.

The availability of new-release product remains largely unaffected, but other categories of purchasing such as impulse, catalogue, promotional and gifting - still key to the industry - suffer as the overall depth of available video product is diminished.

In the UK, for example, the current market leader supermarket chain Tesco and fellow supermarket Sainsbury have mentioned reducing shelf-space for DVDs and BDs as part of their overall strategic development plans. Given these retailers have historically focused on new-release content, the trend of shrinking shelf-space in their stores, may appear less of a concern.

However, the presence of even a relatively small catalogue section promotes content, irrespective of consumption platform, directly to consumers whilst maintaining the perception of choice given by physical formats also known as range depth perception. The benefit in maintaining a catalogue section for individual stores is the ability to sell through aging new-release stock - minimising the volume of product that ultimately would be returned to distributors - and offering lower cost promotional titles. Whilst these sections offer little actual selection, for consumers, they do provide a level of range depth perception. Consumer studies have proven that range depth perception is a key factor in influencing consumers to make in-store purchases.

Overall, the effect of shelf-space reduction is that sales from the remaining selection of titles will decline. Moreover, by reducing range depth perception, purchases are likely to decline by a greater proportion than that suggested by the reduced space allocation. Reduced sales inevitably will lead to lower revenues from the category and may therefore result in further losses in shelf-space, beginning the cycle once more. The cycle can be stopped and even reversed by managed price increases, though this contrasts directly with many retailers' pricing and promotional strategies for the category.

The decline in physical video has without doubt been accelerated as a result of these changes to the European retailer landscape. The principal impact will be a forced change to consumer purchasing behaviour. In IHS analysis, it is the changing video retail environment across Europe - as opposed to wholesale shifts in consumer habits away from disc-based consumption - that is largely the reason why physical video consumption is falling overall. Many European consumers still want to be able to watch movies on discs, but simply find it harder to find outlets to buy or rent video.

Beyond 2013

The importance of retailers in the promotion of physical discs is illustrated by half year data for the big three European markets. While the physical video markets in France and the UK have suffered in the wake of the retailer crisis, German growth in the first half of the year is a testament to the high level of retailer support for physical video.

The decline in physical video is likely to pick up after 2013, as the DVD goes into a steeper rate of decline and BD starts to experience its first annual declines. Digital video will continue to grow, but recent trends suggest that the largest part of this digital growth will be coming from digital subscription services.

For the video industry, this will represent a major challenge as physical video is currently generating the greatest share of video revenues, and the replacement platform digital subscription is a relatively low-value spending model.

TONY GUNNARSSON is an Analyst in IHS Screen Digest's Video team, where he oversees territory-by-territory Blu-ray and DVD forecasts for the Video Intelligence service. Prior to joining Screen Digest in 2008, Tony was an editor at media services firm Precise Media and a journalist with publisher IT Europa.

Contact: www.ihs.com.

This is one of many editorial features included in the annual DVD and Beyond 2013/14 magazine. Ask for your free copy.

Story filed 24.11.13