Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

The rise of Japan's 3D BD home video market; locally-produced titles up

Despite a slump in the Japanese economy following the natural disasters in 2011, the Japanese 3D home video market is growing at a steady rate. Japan has always been a market at the forefront of adoption of new technology, and this is also true for Blu-ray Disc 3D (BD3D), according to TONY GUNNARSSON, Analyst with IHS Screen Digest, who documents the rise of locally-produced titles.

In 2012, the number of Japanese households equipped with a 3DTV, associated 3D glasses and a 3D BD player, and thus enabling playback of BD3Ds, has increased to about 4.5 million in IHS Screen Digest forecasts, up from 2.3 million in 2011. These BD3D-enabled households spent ¥6,823 million ($85.6 million) buying 1.16 million BD3Ds in 2012, representing 9.3% of total Japanese spending on Blu-ray Disc last year.

Proportionately, Japanese customers bought more BD3Ds than their US counterparts - BD3D generated 8.1% of total US BD spending in 2012 - once more reinforcing Japanese consumer's reputation as being particularly enthusiastic about new entertainment technology and products.

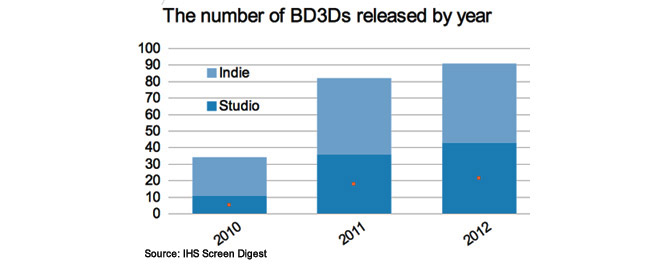

While the demand for Hollywood blockbuster titles remains strong - there were 11 major studio BD3D releases in 2010, 36 in 2011 and 43 studio BD3D titles released by yearend 2012 - there has also been a notable increase in the number of Japanese BD3D releases. In 2010, the number of local titles on the format was 23, in 2011 the number was 46 and in 2012 48 local 3D titles were released. Accordingly, by the end of 2012, local BD3D accounted for a little under one quarter of the total number of BD3D titles released in Japan from 2010 until the end of 2012 (23.2%).

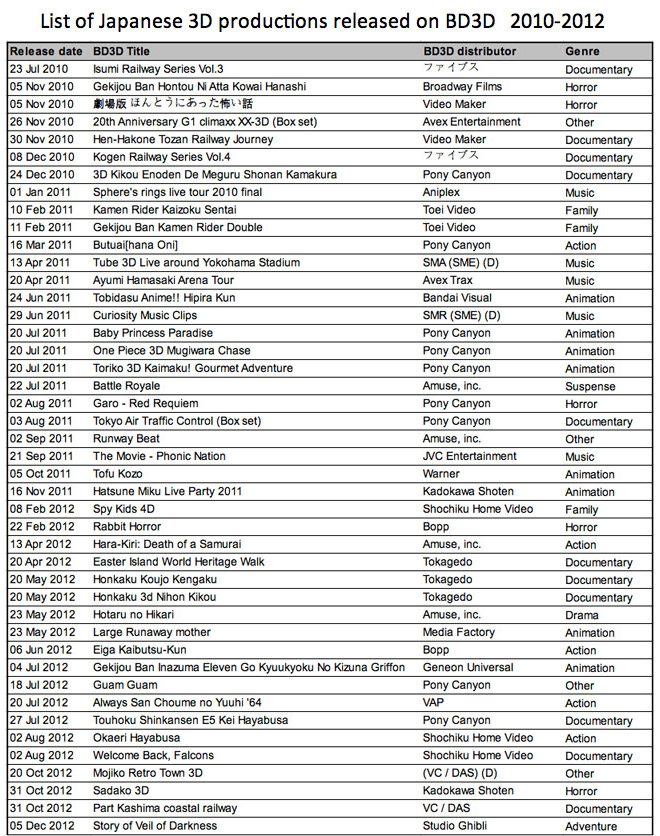

After removing adult and erotic content (which is not directly comparable to mainstream studio product), the total number of titles released on the format in Japan by the yearend of 2012 is 160 (the number of adult titles available on BD3D is 47, slightly higher than the equivalent number of titles in other key international markets). Of these, 42 were local titles distributed by local Japanese distributors. Japanese entertainment giant Pony Canyon is the most prolific producer and distributor of BD3Ds in the domestic market, having released 15 titles on BD3D overall, out of which 13 are local Japanese 3D productions.

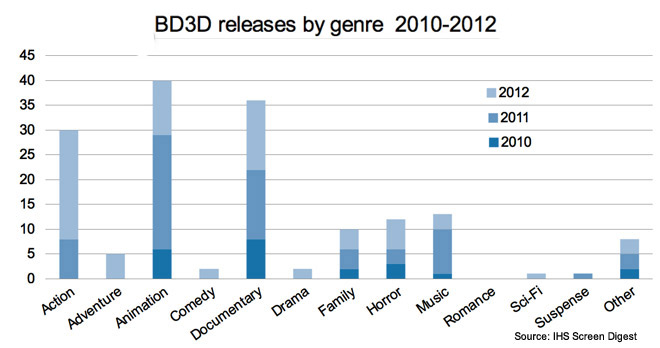

Like in most key markets, the Japanese BD3D market has developed from being heavily based on action and animations genres in 2010, but which in 2011 expanded to all mainstream genres. However, aside from major studio BD3D releases, local Japanese BD3D titles tend to cover niche genres. In our analysis of Japanese BD3D titles released by end of 2012, the documentary genre account for the greatest share of locally-produced 3D content (26.2%) and includes several titles offering aviation and train simulations in 3D.

The animation genre is a close second (at 16.7% of all local 3D titles), which is not surprising considering Japan's strong anime market, and includes the first slate of 3D productions based on popular Japanese anime franchises. Action and horror are also strong genres among locally-produced 3D titles (each accounting for 12.2% of total number of Japanese BD3D releases) with high-profile popular Japanese 3D live-action movies driving consumer interest in Japan's burgeoning BD3D market , including titles such as Hara-Kiri: Death of a Samurai (released by Amuse Soft Entertainment) and Sadako 3D/The Ring 3D (released by Kadokawa Shoten).

In line with Japan's traditional status as a strong entertainment market, particularly when it comes to new technology, 3D home entertainment is likely to continue to grow and establish a small, but important luxury niche market within the greater BD market. As Japan has always been a particularly strong video rental market, the BD3D format may also come to play a role as a rental proposition, and if so, a further driver for adoption of 3D home entertainment.

Finally, the latest round of quantitative easing from the Bank of Japan could stimulate extra demand from consumers eager to embrace new technology such as 3D and promote local 3D film production.

Story filed 04.03.13