Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

Global 3D market flourishes across homevideo, cinema, TV VoD platforms

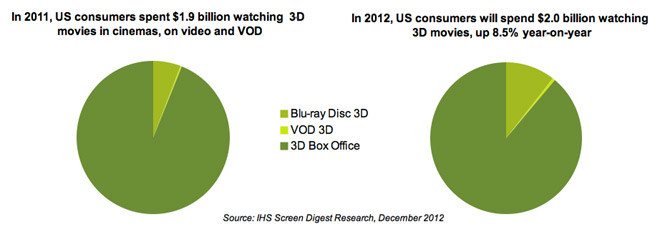

Worldwide metrics are on the rise for 3D technology as a whole, according to IHS Screen Digest's latest Cross Platform Intelligence report. The 3D homevideo market is showing strong growth, bucking the overall trend of a declining physical video market, with US spending on Blu-ray 3D nearly doubling in 2012 from last year's levels. The number of 3D screens is up fourfold over a period of three years, while 3D box office climbed in the double digits from 2010 to 2011. More 3D TV channels worldwide are now available, including one just launched in China, with plenty of potential for expansion in the years ahead for 3D Video-on-Demand service.

3D home video defies overall down trend of physical video market. In the 3D homevideo segment, the US continues to make up the largest market for Blu-ray 3D (BD 3D), equivalent to 51% of global BD 3D spending. And while both value and volume for traditional physical video are decreasing, BD 3D is an exception to the trend, with forecasts showing strong growth even out to 2016. Spending by US consumers on the medium is up 94% this year from 2011 levels, to $220 million, with BD 3D unit sales set to climb 105%, to 9.9 million units.

While growth of the BD 3D homevideo market is also forecast in the three big European markets - United Kingdom, Germany and France - China's BD 3D space is still in infancy, owing to the lack of a legitimate physical video market in the country in light of rampant piracy. The ability of Chinese manufacturers to integrate 3D as standard feature will also have a significant impact on 3D TV broadcasts moving forward, after Chinese public broadcaster CCTV launched the first 3D TV channel in the country on a trial basis earlier this year.

3D penetration is dependent on households upgrading to 3D TVs as well as 3D BD players and the associated 3D glasses. 3D features are becoming a standard on high-end HDTV sets and BD players in the forecast period to 2016, resulting in a growing segment of households in developed markets being ripe for 3D movies viewing.

"Despite the relatively small market for BD 3D, the format plays an important role for overall physical video," said Tony Gunnarsson, analyst for video at IHS Screen Digest. "BD 3D is already being marketed as the ultimate home-video experience, and studios are pricing 3D home-video well above Blu-ray 2D versions."

3D cinema shows growth in both revenue and number of new screens. The number of 3D screens worldwide has grown dramatically in three years, rising by more than a factor of four from approximately 9,000 screens at the end of 2009 to 43,000 by the third quarter this year. The US continues to have the lion's share of 3D screens, followed by China, France, the United Kingdom and Germany.

Meanwhile, global 3D box-office revenue hit $7 billion in 2011 - the last full year for which full figures are available - up 16% from $6 billion in 2010. 3D accounted for 22% of total world box-office receipts in 2011, up from 19% the previous year.

Whereas 3D screen growth is slowing dramatically in the developed regions, where exhibitors have already made a significant investment in 3D screen infrastructure, the opposite is true in China and other emerging international markets. There the continued expansion of new cinema screen infrastructure as well as the subsequent up-conversion rate from 2D to 3D is pushing further growth of 3D screens.

Overall, international markets continue to account for a rising share of the worldwide 3D box office - 73% in 2011, up from 66% in 2010 and 54% in 2009, with the balance held by North America.

Trends in 3D broadcast and VoD show promise. A total of 37 dedicated 3D channels have been launched worldwide since 2010, plus another 38 dedicated 3D event broadcasts. Nonetheless, 3D TV launches slowed considerably in 2012, due to uncertainty about investing in, and maintaining, dedicated linear 3D channels. On the plus side were the positive developments on programming, such as the formation of 3Net, a joint venture among Sony, Imax and Discovery to focus on 3D output including documentaries and other niche genres.

Some pay-TV operators have also sought to provide 3D movies on a Video-on-Demand (VoD) basis. Movies and documentaries - not live or original content - are the basis for 3D VoD, but the overall limited slate as well as the higher price of 3D video-on-demand movies - as much as 30% over HD titles - may serve to discourage some consumers from adopting the service in the short term.

Even so, the 3D VoD market will overcome such obstacles in the years ahead. US consumers, for instance, will spend $76.1 million for 3D VoD by 2016, up from $11.1 million this year. European viewers, meanwhile, will fork out $32.4 million, compared to just $3.5 million during the same period.

"In an age where consumers have at their easy disposal a virtual treasure trove of entertainment options to draw from, the encouraging growth of the 3D medium is remarkable to behold," said Tony Gunnarsson, analyst for video at IHS Screen Digest. "The continuing expansion of the industry is especially significant when one considers that 3D is but a small niche of overall digital viewing, and that consumers have to shell out considerably more money for 3D products, which are priced at a premium and not necessarily an easy sell in these economically uncertain times."

Story filed 21.12.12