Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

FEATURE: The rise of second screen applications

Social media and second screen are buzz words heard everywhere these days. But behind the hype, there is still little agreement on what the second screen market really is and on its importance in economic terms. Drawing on extensive market research and regular contacts with industry key players, RENAUD FUCHS, from Ericsson, offers a clear view on what the second screen market is really about.

Before going further, here are a few facts that explain why we think you should care about second screen:

- Social TV market will be an $8 to $12b business in 2020

- 3 month old Zeebox (leading second screen app in the UK) was valued at £100m in Jan 2012

- 70% of tablets owners said they use their device while watching TV ('second screening')

- Get Glue (a US leading second screen app) has more than 2 million subscribers

- More than 110 second screen apps counted by 'Thoughts on the Digital Video Space' blogger Chuck Parker in early 2012

Defining the second screen market

There is often confusion on what the second screen applications term encompasses. Here we do not talk about using a tablet, phone or laptop to watch video content which is basically using a second screen as a first screen. Here we regard second screen applications (on a phone, tablet, PC) as an application providing functionalities dedicated to improving the viewer's experience. It is accordingly clear that both social applications (Facebook and Twitter) and applications/websites offering related content (IMDB) do not enter the scope of our definition.

Looking at functionalities, second screen applications typically offer services such as content recommendation, additional information on currently watched TV content (related content), social network functionalities, etc. Interestingly, the Second screen market recently expanded from the world of TV to the world of video game as Microsoft, Sony, and Nintendo announced the launch of second screen services for video games at the E3 (June 2012).

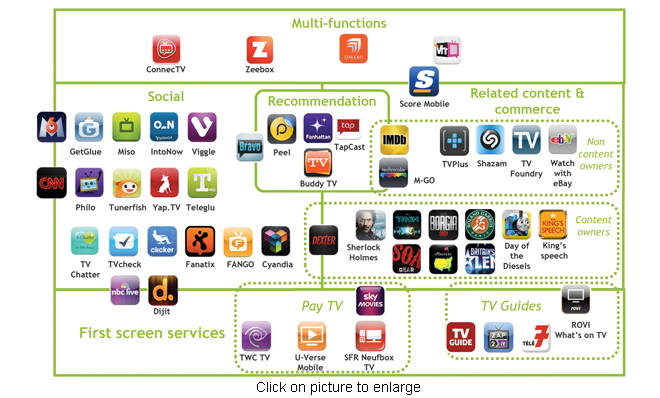

Now that we defined what we meant by a second screen application, let us try to make sense of the market. As shown in chart below, the second screen applications market can be divided in five main segments.

First screen services: those applications provide basic services such as TV guide, film or TV program description. They are provided by companies that already had an interest in the space: typically Sky or Tele 7 jours already have (most of) the information they include in the application. It should accordingly not being surprising that the main business model for this segment consists in 'leveraging existing content.' Thus, applications either leverage existing EPG (electronic programme guide) data - e.g. Tele7 jours - or the information on content's owner programmes - e.g. Sky.

Related content and commerce: this segment contains two main types of players: content owners and non-content owners. Content owners (studio or sport right holders) see in second screen an opportunity to develop new ways of monetizing their assets. A second screen application is therefore launched every time a new film is released (it is a bit similar to the bonus of a DVD). Similarly, applications are released for major sports events (Superbowl, Wimbledon, etc) or even regular season games (Canal+) and provide users with statistics, information on players, replay etc.

Non-content owners are also present in this segment, the best example is eBay. The application 'watch with eBay' allows buying the content on the first screen during a programme. There are two business models for this segment: content owners focusing on 'leveraging existing content' in a different format/ environment (e.g. Tron or The King's speech) and non-content owners expanding their commercial activities (the best example being eBay).

Recommendation: these applications are concentrated around the boiling phenomenon of content discovery, i.e. pushing relevant (time, themes, etc.) content to users drowned by content proliferation. Applications such as Fanhattan or Buddy TV provide film or TV show recommendations based on criteria such as: most popular, what you friends recommend, etc. Note that little functionality is offered when the program is on. Here, the dominant business model revolves around the notion of commission/affiliation.

Social: These applications have a particular place within the Second Screen landscape. First, it originally created the buzz around second screen and Social TV. This segment has, properly speaking, started the Social TV phenomenon. Second, the nature of players is a clear differentiator, mainly consisting of start- ups while the other three segments mostly contain apps from established brands. Third, Social applications are gathering the widest audiences (GetGlue is probably the largest with more than 2m subscribers). Looking at functionalities, services often revolve around a basic functionality called 'check in' - where users can tell their friends (on the app) what they are watching/ reading/ listening to - and programme, book or music rating.

Multi-functions: Applications such as Zeebox in the UK offering a combination of many functionalities (social, related content, commerce, etc).

A brand new ecosystem

The second screen applications have given birth to a new eco system. Key elements include:

Technology providers (e.g. Loyalise, TV Tune in etc). This space is growing as competition is intensifying in the application space. New start up find it easier to become technology provider to second screen application rather than trying to fight in a busy space for an audience.

Advertising networks (e.g. Second screen networks, likers.tv): They offer a way to monetize the second screen audience.

Data analytics companies (e.g. Netbase, Bluefin, and Trendrr): they are key to support the business models based on customer analytics.

Specialised media (e.g. 'thoughts on the digital video space', lost remote). A number of media now have a focus on second screen.

Investor(VC/ PE): They provide the funding for the extraordinary growth of the space.

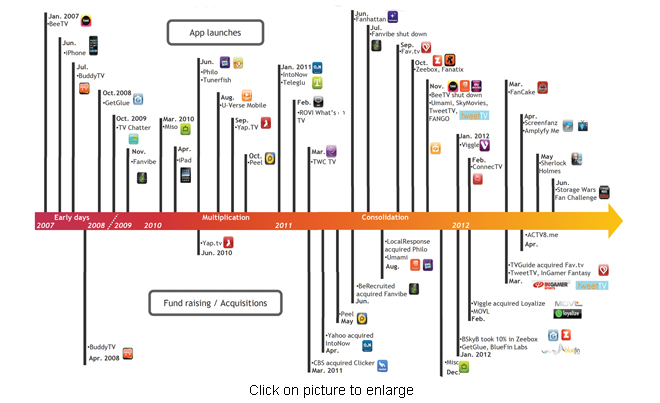

Surprisingly enough, the second screen app market is not new. The first app (bee TV) was launched in early January 2007 or no less than 6 months before the launch of the first iPhone. Six months later, buddy TV was to follow. The second screen phenomenon was beginning to shape. However, over the first three years few applications were released. Thus, in January 2010, only five applications were counted.

2010 was the decisive year as second screen applications began to multiply with six new apps. The launch of the iPad was certainly a key driver to the growth of second screen applications as it reinvented the way viewers consumed content, 70% of tablet owners using their device while watching TV. In 2011 and 2012 the growth continued and accelerated with more than 12 apps launched in 2011. This coincided with the appearance of the first apps in Europe. Born in the US, the phenomenon had started its globalization.

From 2011 onward the volume of deals involving second screen start ups grew very fast. They included fund raising and M&A. While there were only 2 transactions between 2007 and 2011, we counted more than 15 transactions between in 2011 and 2012, undoubtedly a sign of consolidation. Thus, though many apps are still being launched on a weekly basis as money is pouring in via VC and PE, there is some M&A activity but mostly around consolidation between players (TV guide acquired Fav.TV in March 2012).

While this is still the multiplication phase, there are some signs of deceleration and consolidation:

- M&A activity (as described earlier) between second screens and also between second screens and technology providers.

- Intense competition between second screen apps to acquire a critical mass of users makes it easier for new entrants to be a technology provider rather than yet another app.

What are the drivers for this sudden interest in second screen applications?

First and foremost, it is important to highlight the key role played by connected devices and especially tablets and smartphones. Their increased presence in everyday life have positioned them as new companions for watching TV and therefore progressively and durably changed usages. Thus, 70% of tablet owners and 68% of smartphone owners use their devices while watching TV. Similarly, 30% of time spent using a tablet is done while watching TV (20% for a smartphone).

Second, connected devices (in a large sense) have allowed viewers to talk about television and interact with shows in a new way. According to a recent survey 59% of Britons use their smartphone to discuss what is on TV. In the same way, 33% of all discussions on social networks are about traditional media. Last but not least, 26% (44% of under 35 age) of Britons have commented to others, online or via SMS about a TV programme they have been watching.

More users - GetGlue 'Get big fast'?: Here we identify growth in the number of users, usage and engagement as key drivers. Take GetGlue, a leading second screen apps. By the beginning of 2012, the apps gathered not less than 2 million users. Its customer base experienced a tremendous double digit growth, growing by 54% between July 2011 and January 2012. The application also collected an impressive amount of data with more than 350 million cumulative data points on its customers (likes, film or show reviews, checks-in). Interestingly, the application has gathered such a diverse and wide customer base that its usage pattern matches that of TV (peak time between 8 and 11pm). In summary, second screen apps enable providers to gather a large and wide audience offering a considerable data treasure chest.

More time spend on the application - Viggle: is that stickiness?: Launched in the US in 2012, the application provided impressive statistics on its users. Two main elements stroke us. First, the time spent reached an impressive average of 93 minutes, like a good comedy. Second, active users check in five times a day on average.

More engagement - the new age of advertising?: Second screen applications offer considerable prospects for advertising as it opens new ways of interacting with consumer for brands and intermediaries. The recent expansion of the famous Shazam from the world of music to advertising recognition perfectly illustrates how engagement may revolutionize advertising. In May 2012, a 'shazamable' Britain Got Talent advertisement received 50,000 tags within a minute. Similarly, 'shazamable' ads during the 2012 Superbowl generated purchase rates up to 27%. Besides, Second Screen Network, a technology platform specializing in advertising for second screen ran an experiment in partnership with Ford. A Ford ad was shown on TV, offering ways for viewers to interact with the ad on their second screen: respond to a car survey, find more information, etc. What is striking here, is that 23% of people having the apps actually engaged with it. This is far higher than any email or online advertising campaign.

Money pouring into space: Despite unclear revenue models, the second screen phenomenon exhibits some kind of high financial attractiveness. To begin with, valuations went through the roof for small start ups. In April 2011, the 3-month-old IntoNow was acquired by yahoo for $30m. Not bad, is it? Similarly, in January 2012, the 3-month old Zeebox was valued by BSkyB at around £100m. Second, capital raisings have gathered a fairly large amount of money. From 2005 onwards, $215m were raised in 19 deals (there was another 13 deals which amounts were not disclosed). Four of the key applications, Viggle/Loyalise, Miso, GetGlue and Peel raised $50m between 2007 and 2012.

Second Screen is part of content creators strategy: As competition for eyeball intensifies and usages change, content creators and owners have progressively adapted their strategy to exploit new ways to interact with customers. Accordingly, second screens apps are released for programs/films (The King's Speech), TV series (Borgia, Sons of Anarchy, TV channels/networks (HBO), TV groups (NBC live), all the above (Connect, Zeebox). This sudden and marked interest in second screen on the part of content creators drove multiplication further.

With the rapid and tremendous proliferations of similar applications emerges a clear risk for many apps to not lasting long. By the beginning of 2012, blogger Chuck Parker counted more than 110 second screen apps. As Adweek journalist Erin Griffith put it, "the social entertainment apps market has become crowded." As GigaOm blog concludes, even though "at least a half dozen" social TV apps have emerged, "success is [not] falling gently upon every social TV start-up."

Multiplication has also bright sides and most notably it enables identification of key success factors. Here we highlighted the particular importance of user experience and community. User experience must be simple, seamless and visually convincing (attractive look and feel). The app must also facilitate the creation of a community by ensuring maximum interaction between users, enabling the emergence of a community of fans, enabling synchronization with content (live and non live). On the other hand, failure factors include instability (too many or/and too much change), addressing a too narrow community and visual saturation (ads, social feeds, etc.).

Four key elements for the future of second screen

Technology: We clearly anticipate an increase in the number and the sophistication of functionalities provided by second screen applications. They include passive check in and auto synchronisation with set top box (e.g. DirecTV/GetGlue), expansion of devices supporting second screen, integration with social network: Umami launched FreezeFrame, allowing to grab images instantly from the shows and share them via Twitter and Facebook (February 2012).

Some potential game changers: Advertising budgets could start shifting to second screen from the TV. That would accelerate the sector's growth. On the contrary large players (Facebook, Twitter) could enter the second screen space and dominate it.

Multiplication phase: The key element is that the multiplication phase is here to stay for at least well into 2013. This is driven by the investor seeing this sector as a huge growth sector and investing in consequence. News web site 'Lost remote' estimated early 2012 that "Social TV startup activity will double." An MIT scientist called the sector a "bubble."

Consolidation: The multiplication of applications drives a fierce competition for viewers' attention. We expect to see more consolidation as apps unite to get to a critical size and keep their innovation momentum.

RENAUD FUCHS has 10 years experience in strategy consulting with Accenture, KPMG and Greenwich Consulting helping fortune 500 design and execute their growth plans. Renaud then spent 3 years with Technicolor working for the Group CMO as director of Strategic marketing and for the Group Chief Commercial Officer as Vice President Commercial development. He then moved to the Broadcast services division where he is responsible for Strategy, Marketing and Business development. This division was purchased by Ericsson in July 2012. Contact: renaud.fuchs@ericsson.com

This is one of many editorial features included in the annual DVD and Beyond 2012 magazine. Ask for your free copy.

Story filed 12.11.12