Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

INTERVIEW: A replicator adapts to market realities

QOL, Europe's first independent Blu-ray manufacturer, is adapting to France's fast-changing market conditions with the introduction of new services, micro-édition, in particular. In a candid conversation, its CEO LAURENT VILLAUME shares with DVD Intelligence's JEAN-LUC RENAUD his views on the state of the industry, the challenges faced and the opportunities ahead.

Where does the sharp fall in DVD volume leave replicators, is Blu-ray making up for the lost business?

First observation. DVD replication is not longer a profitable activity today for two reasons: too many actors have pushed down the price to an unsustainably low level, combined with a 18 to 20% annual fall in volume that started 2-3 years ago. It is thus impossible to formulate a forward strategy based on DVD replication.

Second observation. The Blu-ray disc market has taken off relatively slowly owing to the fact that the major consumer electronics makers did not have to sell Blu-ray players to sell HDTVs. Fortunately, that is no longer the case with the arrival of 3D. To optimise a 3DTV display requires a new 3D-capable BD player. The French market for 3D TV is slowly emerging, with growth of 20-25% per annum being forecast.

Over a quarter of French households are now equipped with a BD player. Blu-ray is not the golden goose, however. The transition from DVD to Blu-ray is not generating the level of commercial activities we experienced with the transition from VHS to DVD. Blu-ray is essentially a format for new titles, not so much for back catalogue titles, with the exception of a few anthology works such as Coppola's Apocalypse Now, Visconti's The Leopard or Besson's Leon.

Having said that, QOL is very proud of its Blu-ray record. With three BD lines in operation since 2007 we have built a large portfolio that guarantees sustained orders on a monthly, weekly, even daily basis. In fact, this year we see definite growth in réassortiment (re-publishing - additional batch pressing of an existing title) of BD titles, something we had not witnessed last year.

In 2010, the volume of re-publishing did not pass the 10% bar. This year we are reaching 51%. As a matter of fact, more of our pressing activities is re-publishing that manufacturing new titles. This figure shows how strong the growth of BD in France is. For one, I am very happy because we had taken huge risks with the heavy investment we committed back in 2007 and 2008, when we suspected BD was going to explode following HD-DVD throwing the towel.

The years 2009-2010 have been difficult with a slow BD growth, but from 2011 and this year in particular the format is forging ahead. We are Blu-ray leader in the French market today. Most notably, were are able to offer our video publishing clients the same level of quality, flexibility, reactivity and back catalogue management we had provided them with DVD.

It remains that life is tougher today for independent replicators like us, trying to compete with two big actors that control 80-90% of the market. To make matters worse, we are excluded from the proprietary BD games replication market.

What is the Blu-ray disc situation in France in term of strategy, pricing, marketing?

The entire industry now recognises that BD is the key to a successful video publishing sector. We witness the strong growth of 3-for-2 bundles - buy two BD titles, get a third one free. Furthermore, kiosks (news agents) are embracing BD discs as covermount, a sector where they have always been strong.

In terms of the DVD/BD ratio, in 2010 on average 8% of the total production of a disc was in the BD format. In 2011, it was 16% and this year it's between 25-30%. That's an average, meaning some titles, principally action movies, are manufactured in a greater DVD-to-BD ratio whereas romantic titles have a lower ratio.

One forgets the importance of sound in Blu-ray. True Dolby Surround is remarkable. The quality offered is five years ahead of what broadcasters can deliver. Combined with a digital version available online via UltraViolet or other methods, the BD disc offers a remarkable proposition to the consumers for many years to come.

The retail price of both DVD and Blu-ray discs are still too high in France. New DVD titles cost €19.90 and BD titles cost €24.90. Though, after 12 months, one can find this BD title in a 3-for-2 bundle. So, works need to be done by the video publishers on the pricing front. A new BD title priced €19.90 seems to be more reasonable to me. Incidentally, a 3D BD title is the same price as a standard BD.

While new titles are expensive, it is no longer the case for catalogue titles. Deals such as 10 DVDs for €50 are on offer. This should trigger publishers to think harder about pricing. That's not my role as replicator to get involved.

As I mentioned, Blu-ray is principally a format for new titles, not so much for catalogue products. Most of the important catalogue titles have already been published in BD over the past four years. Publishers are no longer going to bring out the BD of an archive movie except for a special event. All this means is that an independent replicator who has not jumped on the BD bandwagon early enough, who has not built a portfolio of video titles, focusing rather on games and music, finds itself in a dire situation.

Blu-ray is a heavy investment, with a replication line costing nearly €2 million when its entire ecosystem is included. At least two lines are necessary to start operation in earnest, combined with experience. Altogether, we are talking of an investment of €4 million with no guaranteed turnover in the absence of a portfolio of titles and facing aggressively competitive prices. QOL has three BD lines.

We had foreseen the market contraction. We bet on BD, we suffered at the late start of the format (2009-2010). Today, we are happy because QOL manages a portfolio of over 1,000 BD titles, which accounts for an excellent market share. That is not the case for everybody.

Is 3D the shot of adrenaline that will sustain the growth of Blu-ray?

It is not 3D that I see as the shot of adrenaline in Blu-ray's arm, that's essentially the price of BD players, which have been in free fall. One can find players for less than €100, even as low as €60-€70. It's a no-brainer now for consumers to swap their ailing DVD player for a BD player, especially as they are likely to own a 1080p TV.

As regards 3D, with a dozen titles our production is of necessity at this stage very small, but picking up. Over one million households have a 3DTV for which there is no 3D programmes. There are no 3D broadcasters in France as is the case in the UK, for example.

Canal Plus has pulled the plug on its 3D service, apparently I am told mainly for technical reasons. High-quality 3D broadcast transmission is still a challenging operation. Let's not forget that Blu-ray is the only physical media capable of delivering two 1080p images, an impossible task for a broadcaster. The BD format has a head start of 4-5 years on all other technologies to deliver high-quality 3D in the home that optimises the living room 3D HDTV display.

3D does not have the success that was predicted. The obstacle is the glasses. Rather, I firmly believe that what will strengthen the key position of BD is the new generation of ultra high resolution TVs in 1-2 years. The so-called 4K (3840 x 2160 pixels) TVs have appeared on the market and the BD format with its ability to deliver a bitrate of up to 40Mb/s will be crucial as the source of content. HD broadcasters are limited to 720p at 11Mb/s.

4K TVs will come because the consumer electronics makers badly need a new product to sustain growth. Also, consumers are now used to shorter product-life cycles and are willing to upgrade more readily their devices. They want ever bigger and sharper screens. Look at what?s going on with smartphones and computers. In my view, the CE manufacturers? salvation does not rest with Internet-connected smart TVs.

QOL is moving into areas not usually thought of as replicator's activities, like B2C, micro-édition (micro-publishing), for example?

We have been expanding and diversifying the range of services we offer our clients, as they are themselves moving into new territories, especially in relation to the Internet. Two years in development, one of the key services we have launched is micro-publishing - an advanced version of manufacturing-on-demand, that integrates all operations associated with B2C including data treatment, website logistics and sales on behalf of the video publishers.

Micro-publishing is born out of an observation. Today, department stores and specialist retailers like FNAC have drastically reduced their shelf space for videos. The number of titles has diminished because the stores want to sell titles that guarantee big returns and, today, these are new titles and promotional deals.

So, the publishing industry finds itself squeezed out of the catalogue titles. Some great movie not included in promotional activities and by definition not new, will no longer see the light of day.

We came to the conclusion that the category of demanding film fans in France interested in quality cinema - the regulars of France 3's Cinéma de Minuit - must be frustrated at the lack of titles that suits their interest. So, we decided to offer a small-run replication service for those titles no longer available on retailers' shelves.

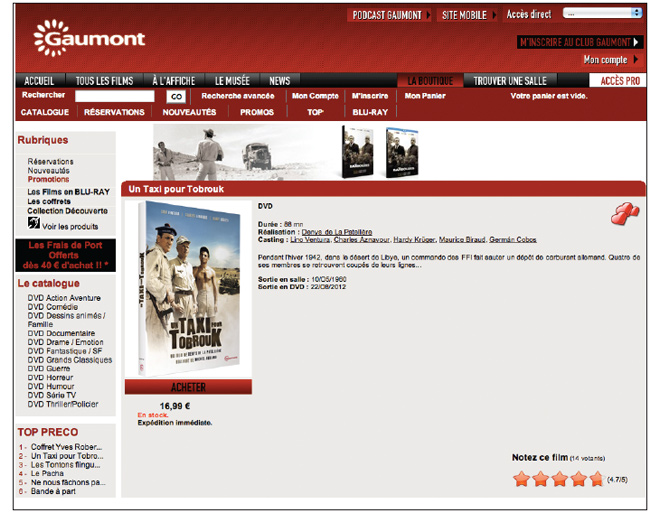

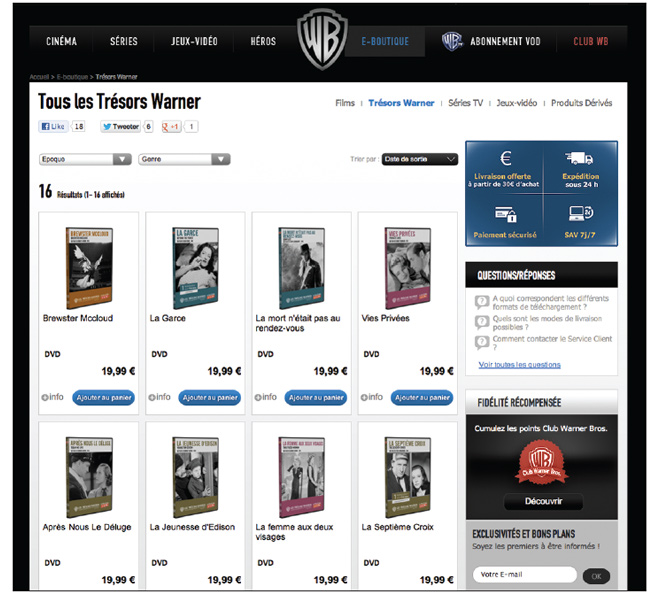

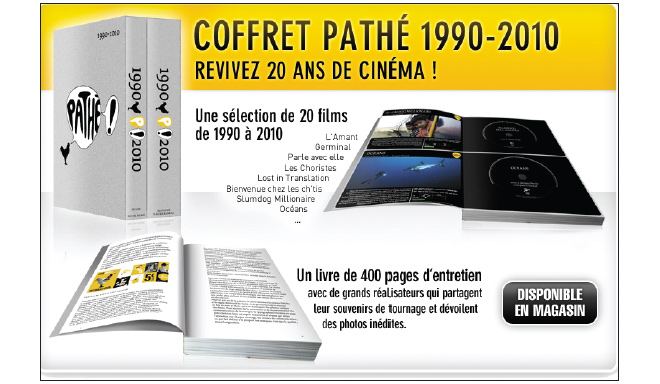

Gaumont got interested and, three years ago, signed a partnership with us. Then came Warner, followed by Pathé, M6 and others. We now work with six publishers. It turns out to be a successful venture for three reasons: first, we bring a new life to films that were collecting dust, but still had a potential. Second, we discovered a community of cinephiles the retailers had lost. Third, these titles bring a lot of traffic to our client's websites.

The marketing of this service is done by publishers. For them, that are an editorial strategy, a collection, a price, a process of retaining consumers, servicing their needs without intermediaries - distributors and retailers. Indeed, that is the first time publishers talk directly to their end-customers.

We have built a 40-strong informatics team operating out of a new 7,000 square meter premises, fully dedicated to the entire B2C video publishing supply chain.

Let's keep in mind that today 15% of cultural products are available on the Internet. Amazon's success is testimony to that. The mechanism is becoming complex and sophisticated and now attracts the traditional distributors.

How successful is this new venture?

Naturally at this early stage, our on-demand replication involves small-run, up to 500 units. Incidentally, the service is a full-fledged standard replication process from the masters, not duplication on recordable media! Volume is slowly increasing. Pathé and Gaumont release some 20-30 titles per month. Gaumont is already proposing 120 micro-published title, at €12,90 each. Pathé's titles cost €14.90.

The average shopping basket of online consumers has 4-5 titles, rarely just one, either to benefit from free delivery and/or because of the attractive choice before them. Also, the novelty of the micro-publishing concept attracts buyers.

Financially speaking, the advantage for video publishers is to bypass distributors and retailers, selling directly to their customers. A client only pays QOL the DVDs sold, no advances are required. Our financial rewards are at the level of the risk we take. A publisher does not pay us the same per-unit price as for regular replication job! Everybody is happy.

The icing on the cake is that high-street retailers like FNAC, who initially refused to distribute these catalogue titles on the basis of their perceived lack of sales potential, are now asking to have these collections on their shelves. Gaumont's DVD-on-demand is a case in point.

In a nutshell, two years ago we bet on micro-publishing - publishing or re-publishing back catalogue titles other did not want. This bet has been won!

Our objective is not to compete with the online operations of the large distributors with whom our clients have already contractual relations. QOL aims to bring complementary services in the B2C arena, not B2B, offering web-based editorial services even managing box office tickets!

While other independent replicators have branched into solar panel components. We did not. We consider ourselves the dedicated partner to the French cinema industry. We have thus developed the range of services that help our clients' turnover. We have focused on their back catalogue, desperately looking for a solution. Micro-publishing and associated activities were the solution, but not the only one.

Contact: www.qolgroup.eu

This is one of many editorial features included in the annual DVD and Beyond 2012 magazine. Ask for your free copy.

Story filed 29.10.12