Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

ANALYSIS: Towards a new era for video and television

Consumers have never had so much choice and flexibility in how they watch movies and TV shows. A generation ago people had to plan ahead for when a particular broadcaster transmitted a movie at a particular time, and make sure they were in front of the TV set when the broadcast took place. This was, after all, pretty much the definition of 'television.' Fast forward to 2012 and those limitations seem quaintly archaic, remarks DAVID MERCER, Principal Analyst at Strategy Analytics.

Not only are many movies and TV shows available on demand from a variety of sources, they can also be paused, rewound and re-watched multiple times, and now, increasingly, on a wide range of screens and devices. And while mobility has not had quite the impact that some had expected, the arrival of 4G networks is finally promising a new era of high-quality video libraries available on the move and from almost any location. It almost seems as though we really can now watch what we want, whenever and wherever we like.

The reality of course is never quite that simple, and while the technology frameworks are largely in place to support this video nirvana, obstacles such as technology adoption curves, value chain wars and, above all, content rights battles still lie in the way of the complete transformation of the video and television industries.

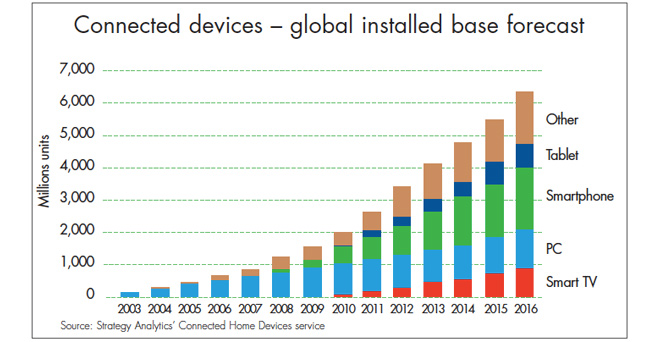

In terms of technology adoption, the most important trend in recent years has been the long-awaited arrival of internet-connected devices. Even way back in the age of dial-up internet the visionaries were predicting a time when every consumer device would be hooked up to the web. Slowly, but surely internet capabilities have been absorbed into a growing range of technology products.

The trend started in the mid-2000s with games consoles and is now making its way into the TV market, where TVs with connectivity have attracted the 'smart TV' label. When we add in personal devices like smartphones and tablets, as well as home computers and other connected devices, we estimate that there are now more than three billion connected devices in use worldwide, and we predict that this number will double again by 2016.

Our forecasts suggest that already in 2012 more than a fifth of homes in the US and Europe own at least one connected or smart TV, and this proportion will rise to more than 50% by 2016. In itself internet connectivity may not help TV viewers very much. Early connected TVs experimented with various limited functionalities, including web browsing and customised widgets offering information on weather, stock markets and so on. It is only with the arrival of internet video services and apps that connected TVs have started to catch the public's imagination.

Strategy Analytics' research shows that many consumers buy connected TVs without specifically wanting the internet features, but once they discover integrated online video services like Netflix, Hulu and the BBC's iPlayer, they become hooked and can't imagine ever going back to a world without internet TV and video.

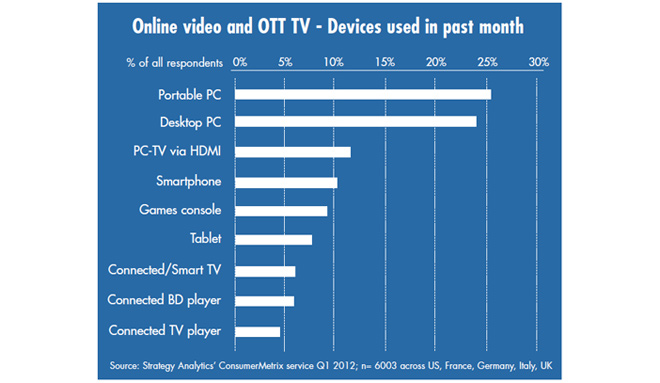

Not surprisingly, these new devices and technologies are leading to major changes in consumer behaviour around the TV screen. In some ways a new battleground has emerged, between the big screen and the personal device. For most of the past decade the home PC has been the main platform for online video and TV consumption, but this has changed significantly during the past couple of years. PCs are still the major video consumption device after the TV, but the arrival of the iPad and other tablets is already changing the way people watch online video and TV.

A quarter of people regularly use a portable PC to watch online video or OTT TV (Over-the-top is a general term for services that consumers access over a network that is not offered by that network operator. Examples are internet-delivered videos received on a living room TV set to which it is connected) and nearly the same number use a desktop. On average, more than a third of people use any type of PC to watch online video each month. But the TV screen is becoming steadily more important: 21% of people are now regularly watching online video on their TV set, using a variety of different device configurations.

The most popular choice is to connect a laptop to a TV using an HDMI lead. Games consoles also figure strongly, while fewer people are using a smart TV or a connected Blu-ray disc player. Usage of tablets for video viewing is already featuring strongly, in spite of the relative novelty of these devices. Across the entire survey sample we found that more than 7% of people are now using tablets to watch video at least on a monthly basis.

As well as watching video on 'second screen' devices, TV viewers are also using them to engage in other activities while 'watching' TV (if that's how we can describe 'not really looking at the screen, but half paying attention'). In other surveys, we have found that 60% of viewers regularly use a mobile phone while watching TV, and 50% use a laptop. A third claim to comment on what they are watching on TV on social networking websites, and nearly as many engage in internet shopping. Surprisingly, perhaps, relatively few - less than 20% - claim to search for information on the TV show they are watching while it is on.

What we have not seen so far is any significant progress for industry-driven multiscreen services, although there has been some experimentation in this direction. For example, a number of live television broadcasts in recent months have been integrated with second screen applications. One example was the Walking Dead programme broadcast by the FX channel in the UK. This programme was accompanied by an iPad/iPhone app which used audio watermarking to synchronise with the broadcast TV content. Our research found that while users were very interested in the potential for this kind of service, the implementation in this case left a lot to be desired.

It is early days, however, in the development of these new media concepts and we will certainly see many more examples in the coming years. Television producers and broadcasters are ultimately creative people who will surely find successful ways of improving stories and viewer engagement using these emerging technologies.

The costs of convenience

When looking at adoption curves we often focus on the question of hardware pricing alone, but most consumers are very careful to take into account all the ongoing costs associated with a new product. In our ConsumerMetrix surveys we ask people about the device cost, installation and set-up and any other monthly fees and costs, and 80% of respondents agreed that they considered the total cost package very carefully when looking at new products and services.

This is an important consideration when we look at the potential for online video, OTT or IPTV services, since they all require a data connection which needs to be paid for. While 70-80% of homes have broadband, only a small fraction of those homes have so far reached the data download limits associated with that service. But as more and more devices start downloading or streaming video ever more often, as well as in higher quality formats, we are going to start seeing download capacity issues coming to the fore.

Whether broadband internet service providers are willing to allow the rapid growth in internet video consumption to continue without demanding additional fees, either from consumers, content providers or elsewhere, remains very much open to debate.

We should also mention the issue of video quality. It was assumed not so long ago that the internet would struggle to deliver the sort of video experience which could compete with traditional TV and video platforms. These questions have largely been forgotten as broadband speeds have increased, and in some cases internet video viewed on the TV screen can be not only satisfactory, but even a high quality experience.

Proponents will claim, rightly, that Blu-ray still sets the benchmark for the best available consumer video experience, and technically it will be difficult for any internet video service to match this in the foresee-able future. But for many consumers today's internet video platforms offer a very adequate experience and as they improve further this will tend to squeeze the growth opportunity for BD.

As we have seen in so many other areas of technology and business, the internet can have a dramatic impact on existing market structures and relationships. Whole sectors can find their business models threatened, and to some degree we have seen this already in home video with the rapid decline in video rental stores in recent years. That phenomenon has resulted as much from a long-term decline in the disc rental model rather than the impact of the internet per se, but the video industry in general is set for further disruption as connected devices proliferate.

One of the key impacts which connected TV devices will have on the value chain is the opportunity for new providers to bypass the traditional set-top box/pay TV model. In recent months we have seen the first examples of pay TV companies offering access to their services without requiring customers to own a set-top box. Most significant of these has been BSkyB?s Now TV service, launched in the UK in July 2012. Currently this service is available on PCs, iOS devices, Xbox 360 and some Android devices; device support will be expanded further over coming months.

Now TV subscribers are currently offered access to the 1,000 or so films in the Sky Movies portfolio, both on demand and also in the form of the regular, streamed Sky Movies TV channels. Pay-per-view movie options are also available. At £15/month the price of the subscription service may seem high relative to existing offers from LoveFilm and Netflix, but Now TV's portfolio comprises many more recently released films and, frankly, a vastly better choice. It?s no coincidence that Sky's Now TV service advertises its online movies as 'same time as DVD release.' It is clearly aimed at consumers who don?t currently buy pay TV, but may be renting or buying DVDs.

We will see similar moves from other pay TV companies around the world during the next few months and years, including the major US cable companies. The set-top box is not going to disappear any time soon because it enables a range of advanced and high-quality services which are still beyond the capabilities of an internet TV service. But many pay TV companies recognise that the long-term future of the traditional set-top box is now seriously being questioned.

As pay TV companies become more like video providers and vice versa, the most important battles will be fought, as usual, in the content rights arena. The pay television market has been built on the ability of providers to secure exclusive access to premium content, and the online video and OTT TV era will be no different. The early success stories in online video, such as Netflix, Hulu and Lovefilm, were established on acquiring rights to content in similar release windows to DVD and Blu-ray, and we have seen the first signs that these emerging players want to compete by developing their own content.

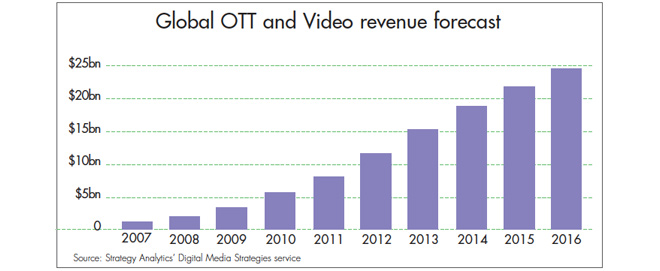

Our forecasts suggest that global revenues for all forms of online video and OTT TV continue to grow strongly. We are projecting revenues of nearly $12bn this year, an increase of nearly 40%, and by 2016 the industry will be bringing nearly $25bn a year.

The rapidly expanding world of online video and emerging user experiences raise the inevitable question: What is the future for discs? As discussed previously, there is still a role for Blu-ray as the quality benchmark and we remain cautiously optimistic for Blu-ray?s growth prospects in the near-to-medium term as it continues to replace DVD, at least in part.

And the industry may also explore the opportunity for a super-BD format based on the emerging 4K and 8K Ultra-HD standards. But the window of opportunity for these physical media platforms is gradually closing and there seems little doubt that, for the majority of consumers, watching video is going to involve some form of online service before the end of this decade.

DAVID MERCER is Vice President, Principal Analyst of the Digital Consumer Practice at Strategy Analytics. He has 20 years experience in analysing and consulting within the digital consumer broadband and media industries. He has worked with major global players across the value chain. Contact: www.strategyanalytics.com.

This is one of many editorial features included in the annual DVD and Beyond 2012 magazine. Ask for your free copy.

Story filed 05.10.12