Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

Video revenues lifeblood of UK film and TV industry, says new report

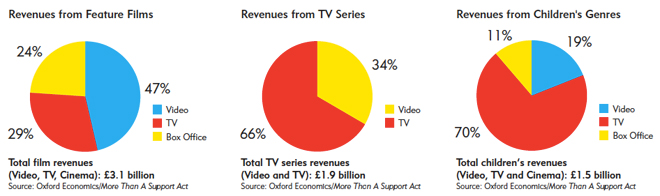

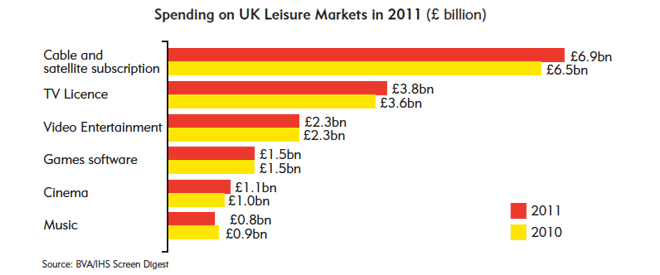

Total UK consumer spending during 2011 on video entertainment was £2.3 billion, representing the single biggest revenue source for the production of film and television drama in Great Britain, confirms a new report just published. Following the Oxford Economics study commissioned by the British Video Association and published a year ago, today's new edition, Ready to Face the Future, reveals that in a rapidly evolving market, video revenues remain critical to British film and television production.

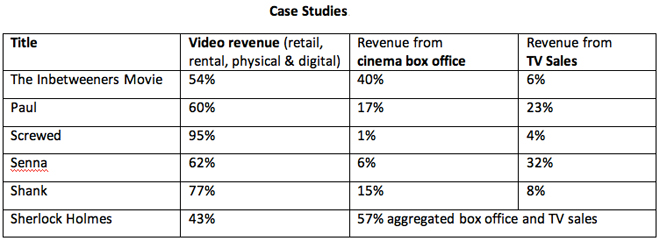

In the new case studies from recent British films, video sales generally account well in excess of 50% of total revenue, up to 95% as in the case of Screwed (see table below).

The report also provides insights from BVA consumer research by Kantar Worldpanel's Entertainment Panel into why physical discs are still account for 88% of consumer spending and points to the importance of measures to combat copyright theft and potential threat from proposed changes in copyright policy.

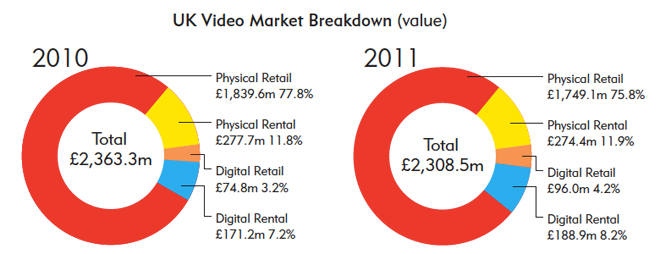

Tough high street trading conditions, rising petrol prices and the increasing influence of internet sales, have put downward pressure on the biggest part of the sector, resulting in a decline in the value of the physical retail market from £1.84 billion in 2010 to £1.75 billion in 2011. Over the same period, Blu-ray Disc and DVD rental values remained fairly static, notes the report.

As a positive counter to the sluggish physical market, the digital sector continues to show growth: digital rental now accounts for 8.2% of market value, showing an annual increase of 10%; digital retail currently accounts for just 4.2% of consumer spending but has shown an annual growth in value of more than 28%. In Q1 2012 digital accounted for 15% of market value.

Video entertainment is critical to the success of key British TV series in the international marketplace. For example, 50% of the total revenues from Dr Who - one of the BBC's global 'superbrands' - is estimated to come from video sales both in the UK and abroad. The BBC series, Planet Earth, was a global success on DVD and Blu‐ray, with sales of seven million units globally, enabling profits generated by BBC Worldwide to be re-invested in further productions such as Human Planet and Frozen Planet.

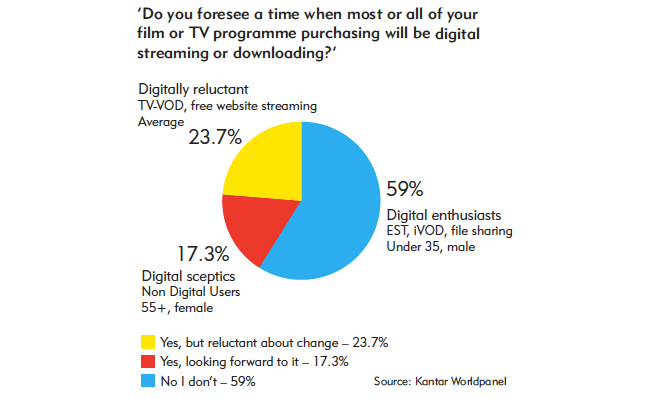

Changing consumer behaviour and the shift of audiences towards increased online viewing of video content is a key issue for the audiovisual industry, which the tracking study carried out for the BVA in 2011 by Kantar Worldpanel has monitored. It found that:

- 80% of consumers have engaged in some form of legal digital activity (54% in the 2010 survey);

- more younger consumers are engaging with digital, both free and paid for, highlighting the likelihood of accelerated growth for these areas;

- 80% of those are watching free, mainly catch-up TV or free ad-funded streaming services;

- 7.2% of consumers have paid to access some form of digital video content, the majority being film content;

- TV-VOD is currently the most successful platform, accounting for nearly half of digital market value. This is expected to increase as more digital services enter the main family room;

- 17% of households have a tablet and 8% plan to buy one in 2012;

- 8.8% of digital film/TV transactional spend was through tablet devices in 2011, and tablet owners are more likely than the average person to pay for video entertainment, averaging a spend of £84.21 per annum compared to a UK average video spend of £60.33;

- 1 in 2 consumers now own a Smartphone and 9% of these say that they are likely to watch films on a mobile, whilst 12% say that they are likely to watch TV on their mobile;

- however, the majority of British people are still sceptical about a totally digital future, driven by older, non&-digital consumers;

- those paying for digital content are far more likely to be enthusiasts, with 44% of them looking forward to it.

"The audiovisual industry is experiencing rapid and dynamic change as a result of digital technologies that create huge opportunities and challenges to a complex creative sector, which is shown in our report to be heavily reliant on video entertainment to generate returns on investment in film and television production," says Lavinia Carey, Director General of the BVA. "It is vital, therefore, that additional uncertainty is not introduced into the sector by simplistic copyright policy changes or hesitancy in enforcing copyright law while our industry evolves, offering more innovative digital services alongside the ever-popular DVD and Blu-ray Disc while maintaining the quality in video entertainment that is so widely enjoyed by British audiences."

Story filed 06.07.12