Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

FEATURE: Packaged media still dominate the European market

Last year, combined online video and TV VOD totalled more than 10% of video revenue in Europe, but the video market in the region remains driven by the packaged media business. TONY GUNNARSSON, from IHS Screen Digest, runs the numbers.

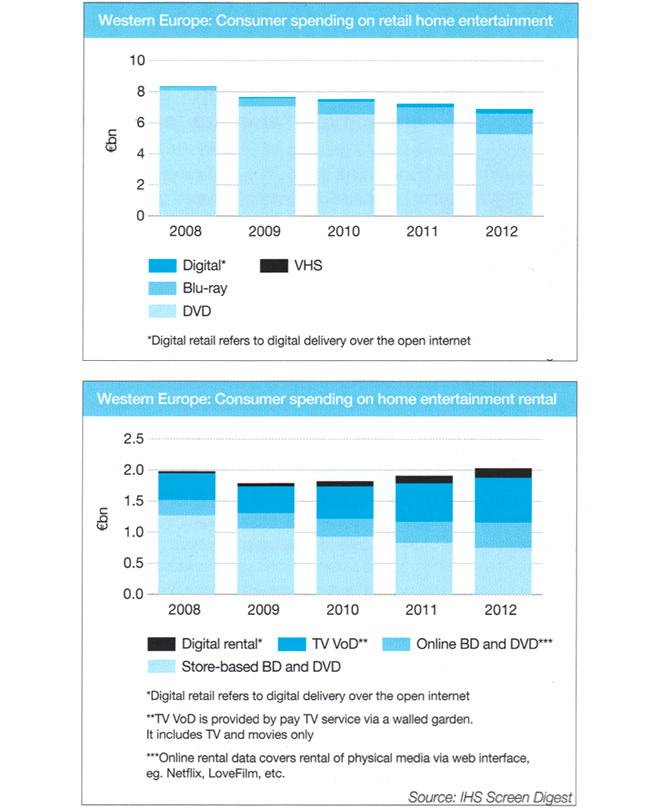

In 2011, European consumers spent a total of €9.14bn buying and renting video across all physical and digital formats, down 2.4% on 2010, according to IHS Screen Digest analysis of preliminary year-end data.

Some €940m of this was spent on digital content - delivered via the TV set or over the Internet - a rise of 26% on 2010. Within this, and in line with 2010, television video-on-demand (TV VoD) was the dominant delivery format for digital video in 2011. In all, Europeans spent €623m on TV VOD, 19% more than in 2010.

Online retail, or electronic sell through (EST), however, was the fastest growing area, up 47% to €208m. Digital rental is about half the size of EST but it has experienced rapid growth also, up 41% to €116m in 2011.

Often heralded as the future of the video industry, a wholly online delivered video business is, however, still many years away. While consumers have begun to view more video through pay-TV and online streaming, the vast majority of industry revenue is generated by packaged video. Europe's packaged video business was worth €8.19bn in 2011 or almost 90 cents out of every Euro spent on video last year. Despite growing demand for online video and TV VOD, Europeans still want to buy and rent physical discs, be they DVD or Blu-ray Discs (BD).

Within packaged video, Western European consumer spending on DVD may have fallen 10% across in 2011 but the format remained remarkably resilient. Western Europeans bought 545m DVDs last year, which combined with BD sales, meant that the total number of video discs sold was above 600m units for the eighth consecutive year.

Let there be no doubt, physical video remains the key driver of the home entertainment business today.

Blu-ray growth

There are also signs that this will be the case for the medium term as well. It is now six years since Blu-ray launched in Europe and, in 2011, consumers in the region spent €1.26bn on Blu-ray discs. For some observers, this represents a disappointment but, it should be noted, that this was more than they spent on buying or renting online video and on TV VOD services combined.

What should also be considered is that, during 2011, the number of European homes with a standalone BD player more than doubled to 15.4m and, if Sony PS3 games consoles are included, the total number of BD enabled households in Europe reached 31.5m.

Blu-ray hardware adoption may have failed to match the speed of its predecessor DVD but more affordable prices mean that more Europeans have converted to hi-def home entertainment systems. By the end of 2012, 35% of European HD TV households will have at least one HDTV connected to either a BD player or a PS3 games console.

Despite this, IHS Screen Digest predicts that only 15.3% of total video spending will be on BD software. The slower take-up was always to be expected, however, because Blu-ray's backwards compatibility with DVD - while a commercial necessity - inevitably meant that not all consumers would swap their video watching to the new format immediately.

This trend, which was also seen in the slower-than-expected transition to DVD in those Asian markets where the Video CD for- mat prevailed, has been exacerbated by the increasing prevalence of digital alternatives - legitimate and illegal - to DVDs and BDs.

Digital consumption also has been made easier through the rise of connected HDTVs and BD players and video streaming apps. Finally of course, the global economic situation of the past few years has made consumers think much harder about how they spend their money with the decision of whether to buy or rent, on physical or digital and in standard or high definition increasingly made on a title-by-title basis.

Germans get the Blus

One European market, however, stands out for its enthusiasm for Blu-ray: Germany. Early indications are that this was one of the only European video markets to report a stable physical video market last year, with combined spending on DVD and BD flat at €1.62bn.

Germany's BD market continued to grow in 2011, up 36% to Euro294m, compensating for a 6% decline in DVD spending. While not a new phenomenon, this does run counter to historic patterns. Germany traditionally boasts a strong early adopter market when it comes to new technologies, but past experience shows that early enthusiasm has failed to translate into mass market success. The result has been that video software spending in Germany has consistently ranked below France, despite containing around 40% more video homes.

This changed in 2007 and, last year, Germans spent 27% more than their French neighbours on physical media. The biggest reason for this shift was the active and consistent promotion of the hi-def format by leading local retailers Media Markt and Saturn.

With a stable packaged video market, the combined German spending on physical and digital video increased by 1.3% last year, to €1.72bn. Despite German consumers being relatively slow to take to online video and TV VOD, compared with consumers in the UK and France, growth in digital video was enough to ensure an uplift for the overall market in 2011. Digital video in Germany only accounted for 6% of total German video spending in 2011, compared to 12% in the UK or 15% in France.

By contrast, France's strong TV VOD market is the biggest driver of its video sector. Overall, French physical and digital spending was down just 2.6% to €1.56bn last year, thanks to a strong combined performance from the online and pay TV VOD sector (up 34% to €230m). Despite rallying in recent years, the physical business in France is in decline again, with spending on video discs falling 7% to €1.28bn in 2011, even though BD showed respectable growth of 36% to €236m.

The rate of decline in overall DVD spending last year in France was worryingly steep, down 14% to €1.05bn; the downturn in retail spending was exacerbated by the fact that the French video rental market - unlike those of the UK and Germany - remains underdeveloped.

Rental behind US

When it comes to consumer spending on video rental, Europe generally lags behind the US, where spending on the sector not only matches that on video retail but has recently returned to growth.

In Europe, the video rental market has fallen for the last decade but, in 2011, the rate of that decline slowed significantly to just 2.5% (Euro1.17bn) compared to an 8.9% fall in 2010.

This was in part due to the strong growth across Europe of BD rental, which has grown faster than BD retail in virtually every European market. Also helping the sector was the continued growth in the online subscription rent-by-mail services in the UK and Germany.

Interestingly, a recent revision to the methodology that underpins the analysis of both the retail and rental video markets in the UK has shown that rental still accounts for 14% of total UK spending on video software, as opposed to less than 10% as previously reported.

According to IHS Screen Digest analysis of the revised UK rental data, British consumers spent €316m renting DVDs and BDs in 2011, a decline of just 1.2% compared with 2010. This reflects not only continuing growth from the European rentals-by-post leader Lovefilm, which has promoted its services aggressively since being fully acquired by Amazon, but also a strong store-based rental performance by Blockbuster, which dominates the brick and mortar rental business.

In addition, IHS Screen Digest analysis of the latest revised rental and retail numbers for the UK shows British consumers spent €2.33bn on packaged video alone last year, down 4% year-on-year. This reflected a decline of just 6.6% in DVD spending, to €2.03bn.

More worrying, however, was that spending on BD retail grew by 11.7% only to €257m. This is in stark contrast to the rental business where IMS analysis shows that spending on Blu-ray rose 28% in 2011 to €43.2m.

These different trends reflect the different retailer strategies at play in the two sectors. The collapse in recent years of the UK's once powerful audiovisual specialist sector has left the market dominated by supermarkets such as Tesco and Sainsbury's. These accounted for approaching half of all video unit sales in the UK in 2010, according to the British Video Association, but less than 30% of Blu-ray sales.

Recently rescued (at least for now) HMV remains crucially important to the UK video market as the only entertainment chain prepared to offer the breadth of BD titles needed to give the format the exposure it needs on the high street. As a result, for many consumers, the bulk of BD purchases are made online.

On the rental side, however, Blockbuster is disproportionately supportive of Blu-ray, not only on the rental side - where its strategy of price parity between the two formats actively encourages BD owners to rent the higher spec format - but also at retail, where our analysis shows that in 2010 the rental chain's share of BD sales was three times that of its DVD share.

Tony Gunnarsson is an analyst in IHS Screen Digest's Video team where he tracks and analyses developments in the European video sector, in particular across Northern, Central and Eastern Europe. Contact: www.screendigest.com

Story filed 12.04.12