Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

Emerging markets will push up 2015 global movie spend close to $70bn

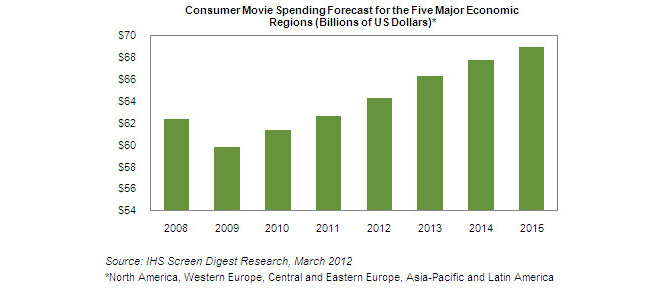

Driven by strong increases in emerging markets, global consumer spending on movies is expected to rise for six consecutive years, expanding from $61.4 billion in 2010 to $68.9 billion in 2015, according to the IHS Screen Digest Video Intelligence Service.

As a group, consumers in the five key global economic regions are steadily increasing their movie spending, an area consisting of cinema tickets, Blu-ray and DVD rentals and purchases, TV-based or online video on demand (VoD) and pay-as-you-go streaming services. Spending on movies in 2011 hit a record of $62.6 billion, up 2.1% from 2010. The total is expected to rise by 2.6% in 2012 to $64.2 billion.

The figure beloe presents consumer movie spending in the world's key markets of North America, Western Europe, Central and Eastern Europe, Asia-Pacific and Latin America.

"The expansion in global movie spending is being driven almost entirely by consumers in the growing economies of Asia-Pacific, Latin America, and Central and Eastern Europe," observed Richard Cooper, senior analyst for video at IHS. "This is occurring despite the fact that the three regions combined accounted for only about one-third of total global movie spending in 2011. The remaining two-thirds of the spending was generated by consumers in the mature markets of North America and Western Europe where growth has stalled."

Movie spending in Central and Eastern Europe will rise at a compound annual growth rate (CAGR) of 8.9% from 2010 to 2015, while Asia-Pacific will expand by 6.5% and Latin America by 4.2%. In contrast, the developed economies of North America and Western Europe will grow at CAGRs of 0.2% and 1.1%, respectively, during the same period.

The divergent trends between the mature and developing markets mask underlying changes in patterns of movie consumption that are expected to drive growth during the next few years.

Home-video spending is declining

In developing markets, the lower take-up of home-video hardware as well as escalating piracy rates have prevented the legitimate physical video business from expanding beyond a high-end niche - and in some cases from developing at all. As a result, the mature markets of North America and Western Europe generate a disproportionate share of movie consumption via home video.

Sales of DVDs and Blu-ray Discs accounted for less than 30% of all movie spending in these regions in 2011, down from almost 40% at the market's peak in 2004. Initially, the downturn in spending reflected the failure of growing volume sales to compensate for falling prices, but volumes in the last few years also have been in decline.

Meanwhile, though the long-predicted death of video rental may be edging closer in Western Europe, in Japan its decline has been much more measured. Even in North America, video rental remains one of the most popular ways to view movies, with last year marking the end of eight successive years of North American rental spending decline, thanks largely to the widespread introduction by operators like Redbox and NCR of low-cost video rental kiosks.

Consumers resistant to paying for movies online

Digital purchase, otherwise known as electronic sell-through (EST), and Internet VoD - aka digital rental - accounted for just 2% of movie spending in North America in 2011 and slightly less in Western Europe. Outside North America the online environment is highly fragmented; linguistic and cultural barriers mean most providers serve only a fraction of the number of consumers that an equivalent North American provider can reach, reducing the funds available to invest in content.

Perhaps surprisingly, online delivery in Japan also remains small - take-up of devices, even those of market leaders Apple and Xbox, is still limited and the available content mix is comparatively poor. However, it is online piracy that remains the biggest barrier worldwide to creating a viable digital movie business.

Consumers will still pay for the real movie experience

Pirates cannot replicate the experience of "going to the movies," and IHS research shows that consumers in developing markets are choosing this way of watching films more frequently and in increasing numbers. Accessibility of movies in developing markets has increased dramatically: in China alone, IHS research shows an average of eight new movie screens built each day through 2011.

In itself this would be sufficient to make theatrical movies the key driver of growth globally, but theatrical spending is also growing in mature regions where theater numbers and attendance rates are stable.

And while box-office prices tend to rise with inflation, they have been boosted further by the introduction of 3-D, allowing theaters to charge a premium for 3-D showings.

As a result, the theatrical sector - which already accounted for $31 billion, or 50%, of movie spending in 2011 - will generate $41 billion annually by 2015, equivalent to 59% of total spending.

Almost $6 billion of that increase will have come from the developing regions of Asia-Pacific, Central and Eastern Europe and Latin America, with a further $4 billion generated in North America and Western Europe.

Despite the declines in some other sectors, this growth will help swell transactional movie spending to almost $70 billion in 2015.

Story filed 14.03.12