Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

Cloud-based digital lockers, ownership rights hard to understand, PwC reports

While awareness has increased, consumers still lack a strong understanding of the benefits of video content digital lockers (ie. UltraViolet) or the rights that come with ownership, according to findings of a major survey, Digital Rights and Cloud Storage, by PriceWaterhouseCooper's Entertainment, Media and Communications practice.

Also, consumers appear unwilling to pay for such services, though their desire to ubiquitously share content may present future revenue generating opportunities. "Ultimately,"? says PwC, "the success of digital lockers will depend on whether companies can match the benefits with consumers' desires ensuring consumers fully understand the value of digital lockers for all types of content."

A reprise and update of the same topic explored qualitatively in March 2010, this report includes both quantitative findings from an online survey conducted among a geographically dispersed sample of 502 men and women aged 18-59 in October 2011, as well as qualitative discoveries gleaned from focus groups conducted in November 2011 in Los Angeles among mixed groups of men and women aged 21-49.

Key findings

Nearly two-thirds of the consumers surveyed said they feel confident about their awareness and understanding of the concepts of both 'digital storage' (66%) and 'cloud storage' (61%). There is however a discrepancy between the consumer perceived vs. actual knowledge. Those who currently engage in file sharing seem to be more confident than those who don't. Nearly half the 502 people surveyed (47%) said they currently access file sharing software.

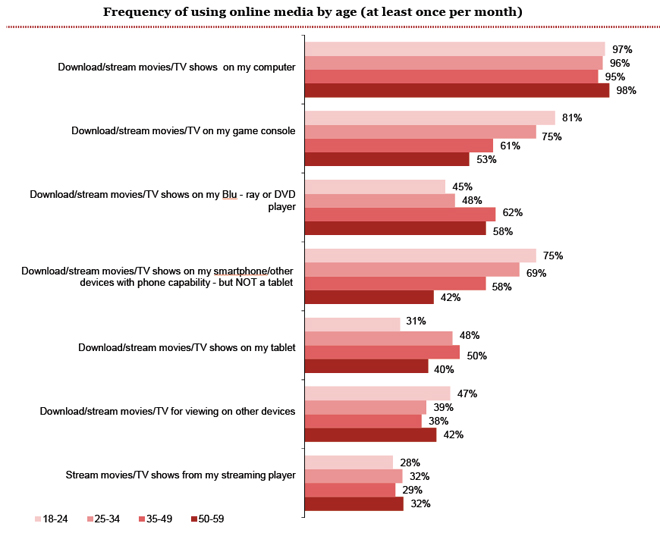

Consumers across age groups continue to be heavily engaged in downloading and streaming movies/TV shows at least once per month or more. The top three device types downloaded/streamed to once per month or more are: Computers (96%), Game Consoles (68%), and Smartphones (or other device with phone capability) - 62%.

PwC provided consumers surveyed a digital locker example, with the following explanation:

Your locker is an online personal library that gives you greater flexibility with how and where you watch the movies and TV shows that you purchase. Once you purchase a movie or TV show and add it to your Library, you will have options to stream it over the Internet, download it for offline viewing, or play it back on a disc. Because the Library offers so many viewing choices, you have greater freedom to choose where you want to watch - whether it's on a mobile device, computer, television, game console, etc. In its current introductory phase, this is a free service.

Only a very small percentage (18%) of survey respondents currently use a digital locker for video storage. Of this group, there is a slight skew to the 35-49 age group.

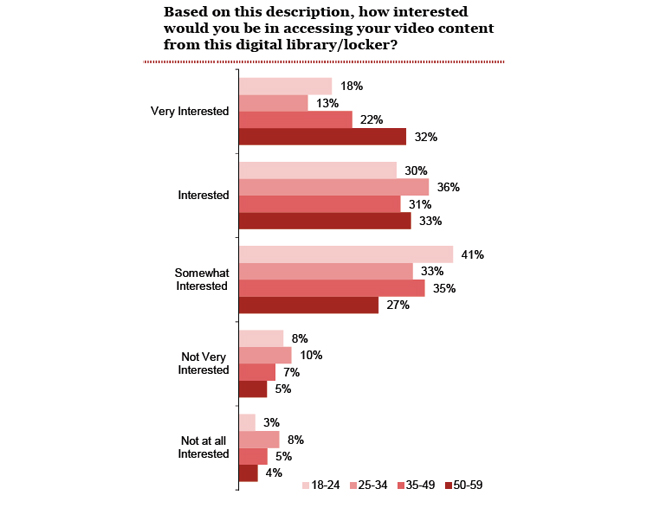

The idea of storing and accessing content from a digital library is interesting to consumers. Nearly 90% of survey respondents are 'omewhat' to 'very interested' in the concept. Among those (20%) who are ???very interested,??? the oldest age group (50-59) expressed significantly more interest than the younger two (18-24; 25-34) age groups.

Consumers had many questions relative to content they could or would store, as well as pricing. They were interested in the ability to digitally store their current content (family movies, photos, videos, etc.)

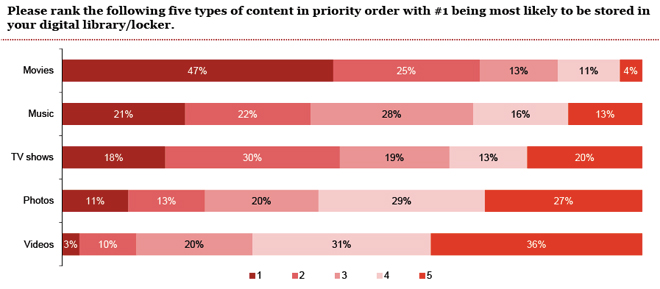

Of the five types of content the focus group respondents considered, movies and TV shows were ranked as the top two most likely to be stored in a hypothetical digital library/locker.

- 72% of survey respondents supported 'movies'? as their #1 or #2 ranked content format most likely to be stored in a digital locker. This was driven by the 50-59 age group.

- 48% ranked TV shows as #1 or #2

- 43% ranked music as #1 or #2 (a result significantly skewed by the 18-24 age group)

The premise that only purchased content can be stored in a digital locker/library had some impact on survey respondents' intent to change their current rental/purchase behavior. 28% reported they would purchase more and rent less.

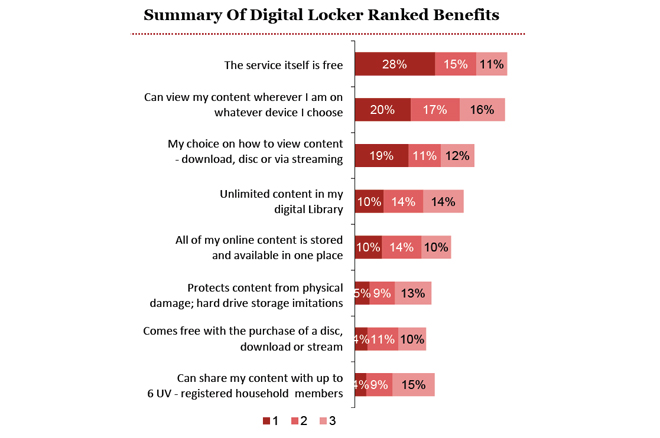

Based on the digital locker description provided above, respondents ranked eight potential benefits and were asked to rank them by importance.

The benefit of getting the digital locker for free is the top-ranked benefit. This was significantly more important to those who are not currently engaged in file-sharing than those who are and who are likely more familiar with paying for such a service.

In general, this underscores consumers' current unwillingness to pay anything at all to get the service. Focus group respondents expressed a bit of apathy and cynicism, which was reflected in their willingness to pay based on their being unclear about the extent of the benefits.

Consumers rated the second most important benefit of digital storage as the ability to view content wherever I am on whatever device I choose. This was significantly more important to the 25-34 age group than other groups.

Least important attributes of cloud based storage:

- The concept of being able to share content with multiple registered household members did not resonate with consumers. The lack of interest in sharing with other household members may imply that more sharing behavior is done with people outside the household than within it. Focus group participants explained that they would want to share it with members outside their home - for free.

- Furthermore, consumers were confused about how 'household users'? are defined verified, and could not determine the benefit of the ability to share content with members of the same household, since their primary motivation was for their own enjoyment.

- There was a perception that the number of registered users may affect the pricing - most consumers did not have six people in their household, and wondered if they would not be receiving the full benefit of the service if they did not have six people living with them.

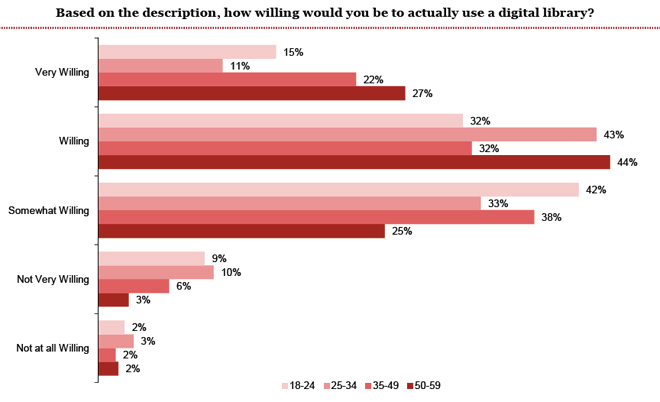

Based on the description, more than half of survey respondents express a willingness to actually use a digital storage library/locker. This is driven primarily by the 50-59 age group. The 35-49 age demographic seems to be more interested in the concept of digital lockers than the younger age groups.

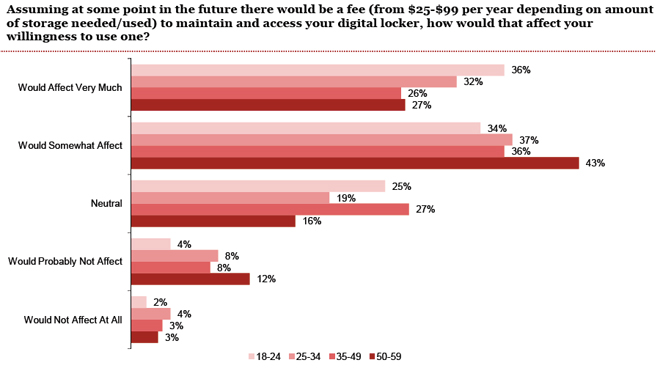

However, when presented with a possible fee for access and maintenance (e.g., $25-$99 per year), most survey respondents (68%) say their willingness to use a digital storage library/locker would be 'somewhat' to 'very much' affected, while 22% express neutrality on the issue.

Furthermore, there was concern about the potential that any of the current studios associated with digital lockers could end their participation in the service. Consumers were worried about the impact that could have on their digitally-stored content.

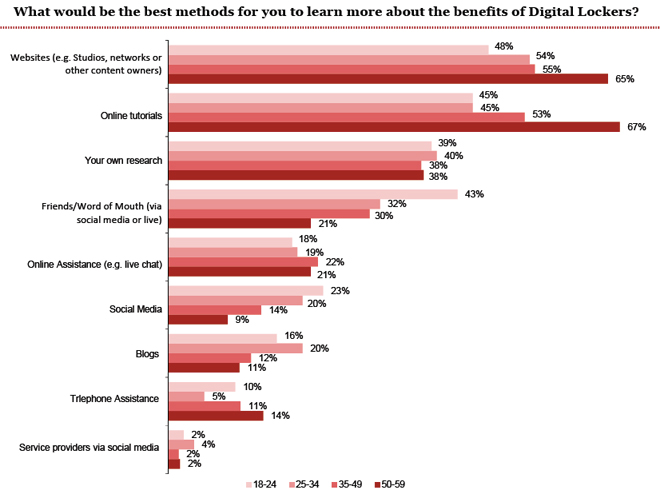

Of nine potential ways to learn more about the benefits of digital storage, most survey respondents said they would turn to websites and online tutorials.

Key implications

Awareness of the concept of cloud digital storage appears to be increasing. However, many consumers still lack a specific understanding of the true benefits and value proposition of such services, as the personal value of digital locker ownership has not been communicated. Companies that are part of the digital locker value chain should focus on delivering benefit-driven messages, and ensuring the benefits of such services match what consumers want, says PwC.

Consumers do not know enough about the concept of rights ownership and management. Companies should work toward educating consumers about the rights and associated benefits that come with digital locker ownership, especially as many are used to sharing material with people outside their homes, with little regard as to whether or not they are infringing on copyright violations.

Opportunities for more focused marketing exist:

- Given the increased interest by the older age demographic, digital locker services should increase initial marketing spend and focus on this group.

- A significant number of younger consumers - higher than in previous studies - expressed a desire to download or stream content to game consoles. Focus on communicating the benefits of digital locker delivery through these devices should be placed on the younger demographic.

Because music and photo sharing are the most frequent activities among file-sharing participants, companies may have an opportunity to draw consumers toward using digital lockers by promoting these options along with video content storage. Meanwhile, as consumers are less interested in sharing film and TV content, companies may be able to make inroads there by discovering what factors make consumers want to share a movie or TV content.

Storing existing personal content should be a highlighted benefit, and can potentially be used as a catalyst for introducing a fee. Consider pricing models attached to this content as a cost of entry to using the service.

Until there is mass consumer adoption of digital lockers, it is critical that digital locker offerings remain free. Consumers are currently averse to paying for digital locker storage/access, and attempts to implement costs will likely be met by consumer backlash.

Consumers aren't particularly interested in the benefit of sharing access to content with other members of their households, as they are more likely to share content with people outside their homes. Companies need to clearly define a household member and the ability to share with family and friends. There may be an opportunity to increase interest in digital rights locker 'ownership,' including willingness to pay, if content sharing ability is a clear benefit.

(All tables, source: PriceWaterhouseCooper's Entertainment, Media and Communications, 2012)

Story filed 12.02.12