Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

FEATURE: Theatrical sector key driver of global movie spending growth

Despite the proliferation of video-enabled technology, consumers are spending more than ever on going to the cinema. IHS Screen Digest's RICHARD COOPER explores how feature film consumption is changing around the world.

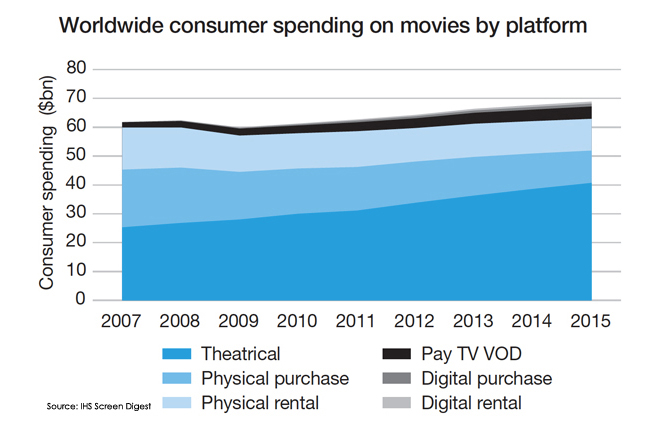

Last year consumers worldwide spent $63bn on watching movies. This includes all movies paid for at the point of transaction, i.e. those watched at the cinema, on Blu-ray or DVD (whether bought or rented), through TV-based or online VOD and through pay-as-you-go streaming services. It excludes movies paid for on a subscription basis, whether pay TV channels (including movie channels) or online subscription streaming services.

Despite the explosion in competition from non-movie genres such as 'must watch' TV series and reality TV in recent years, spending on movies has grown almost every year over the last decade. (The one exception was 2009 when the onset of global recession, combined with exchange rate fluctuations, resulted in a downturn of 4%.)

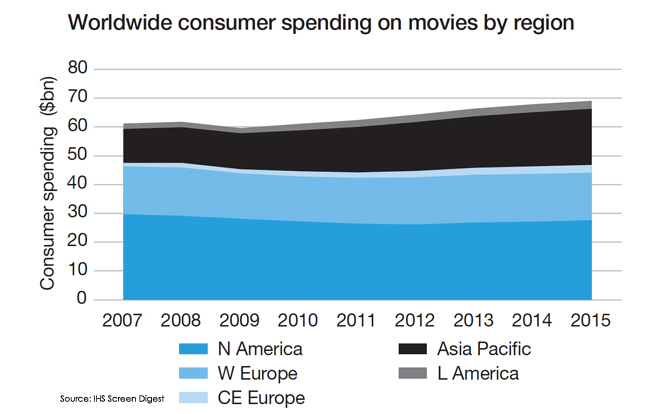

This growth has been entirely driven by consumers in Asia Pacific, Latin America and Central and Eastern Europe (CE Europe), with each region recording a compound annual growth rate (CAGR) of around 5%-10%% over the past five years. However, in 2011 these three regions combined accounted for barely one third of total global movie spending, according to IHS Screen Digest analysis.

The remaining two-thirds was generated by the mature markets of North America and Western Europe, where movie spending shrank between 2007 and 2011 (CAGRs of -2.4% and -0.8% respectively). Although these declines were relatively small, the sheer size of the combined markets means they effectively stymied growth in total worldwide spending on movies, which recorded a CAGR of just 0.3% over that period.

However, further analysis shows that these contrasting trends mask changes in patterns of movie consumption that we expect to tip even the mature markets back into growth over the next few years.

North Americans just love movies!

The data confirms that consumers in North America spend far more on watching movies than their counterparts anywhere else. This is because North American consumers simply buy more, rent more and go to the movies more often than those in other regions. Overall Western Europeans come closest, but despite paying marginally more for the same content through almost every channel, they manage to spend on average only half what the average North American consumer spends each year.

Average movie spending in Asia Pacific is as a region very low, due in part to very low consumption of legitimate product in China, which accounts for 1.4bn consumers - almost half the entire regional total - and to an average price per movie that is around half that in North America.

However Asia Pacific is a region of contrasts in entertainment as it is in other ways. Japanese consumers - by far the most active in the region - are avid video renters, renting on average over 11 DVDs or BDs a year each, half again as many again as even the average North American (7 rentals per person).

IHS Screen Digest's analysis shows that whilst North America accounts for only 9% of the TV households covered, the region generated 42% of total consumer spending on movies last year, a position which remains unrivalled through to 2015, the end of IHS Screen Digest's current forecast period. At 25%, Western Europe is currently the second largest market worldwide for transactional movie spending, but it is set to lose this place to Asia Pacific this year. The latter region also accounted for 25% of worldwide movie spending in 2011, just $81m behind Western Europe, but in 2012 it will edge ahead, generating movie spending of $17bn compared with Western Europe's $16bn.

Home video spending is declining

North America and Western Europe are mature markets in terms of transactional movie spending. Consumers here embraced the availability of movies for rental on VHS in the 1980s before the launch of DVD shifted the balance towards video purchase, driving the huge increases in spending in the 1990s. This boom continued through the turn of the century, but spending on transactional movies has declined in recent years, with a downturn in home video sales being the biggest contributing factor.

Sales of DVDs and BDs accounted for less than 30% of all movie spending in 2011 In North America and Western Europe, down from almost 40% at the market’s peak in 2004. Initial declines reflected the failure of volume sales to compensate for consistently falling average prices, but in the last few years volumes too have been falling.

In Japan, however, and uniquely for a mature market, the purchasing of movies on DVD has always been a relatively niche activity. Average prices are extremely high (over $30 for a DVD and $48 for a Blu-ray) but this doesn't appear to be the barrier; distributors who have tried to stimulate sales by lowering prices have found they simply end up selling the same number of discs for less money.

Meanwhile, while the long-predicted death of video rental may be edging closer in Western Europe, in Japan its decline has been much more measured, even reversing in some years, while in North America video rental remains one of the most popular ways to view movies. Last year marked the end of eight successive years of North American rental spending decline, thanks to the widespread introduction of low cost video rental kiosks, such as those operated by Redbox.

This development increased the availability of video rental at a time when traditional rental stores were closing, resulting in renewed consumer interest. These kiosks are now ubiquitous throughout North America and the flat $-per-night rentals with which they attracted cash-poor Americans at launch are now increasing in price, boosting consumer spending on rental once more.

Europe's physical video market also began as a rental business, of course, but many Europeans have effectively lost the rental habit in favour of buying video. The European Rental Rights Directive allows distributors to charge more for rental copies and this, combined with an average rental rate of less than transaction per person per year makes US-style kiosks a less profitable proposition.

Consumers reticent to pay for movies online

Digital purchase (also known as EST) and Internet VOD (aka digital rental) only accounted for 2% of movie spending in North America in 2011 (slightly less in Western Europe). Initially, online movie prices were typically around 30% lower than DVD prices and followed a similar downward trend. However, this has now changed.

The dominant online delivery channels - iTunes, Zune, PSN - are all closed device-based systems so there is little direct competition between them. Instead, low movie prices were used to keep these ecosystems attractive to new consumers. Now, however, wider availability and demand for hi-def content has started to edge average digital prices upwards, closer to those of physical video.

Compared to North America the online environment in Europe is more fragmented; linguistic and cultural barriers mean most providers serve only a fraction the number of consumers that an equivalent North American provider can reach, reducing the amount available to invest in content. Perhaps surprisingly, online delivery platforms in Japan also remain small - take-up of Apple and Xbox devices is still limited and the content mix available is relatively poor compared to those in other developed markets.

Since this research specifically covers movies paid for at the point of transaction, the steady growth in Pay TV subscription spending over the past decade can also be considered a limiting factor. This growth is driven not only by increasing subscriber numbers, but also by growth in higher-value premium services whose improved variety and quality of content has also helped depress spending on physical media. Similarly the still tiny, but rapidly expanding, online subscription sector (including companies such as Netflix and Lovefilm) has negatively affected spending on EST and internet VOD. Meanwhile, online piracy remains the biggest barrier to creating a viable digital movie business worldwide.

Consumers will still pay for the real movie experience

However, the experience of 'going to the movies' is not so easily copied and our research shows that consumers in developing markets are choosing this way of watching films more frequently and in increasing numbers. In the world's largest developing market, China, consumers spent over three times as much at the cinema last year as they did in 2007, a figure that will double again by 2015. The accessibility of movies in developing markets has increased dramatically with an explosion in the number of multiplexes and new developments.

This year China's theatrical building boom alone will generate an average of eight new movie screens a day, a trend echoed in every developing market worldwide and in particular in CE Europe and Latin America.

In itself this trend would be sufficient to make theatrical movies the key driver of movie spending growth globally. However, our analysis shows that cinema spending is also growing in mature regions where the number of theatres and attendance rates are fairly stable. Unlike DVD or BD prices, cinema ticket prices tend to rise with inflation. Meanwhile, the introduction of 3D, made popular by films such as 2009's smash hit Avatar and maintained in the public consciousness by films such as the Oscar-nominated Hugo, have boosted ticket prices even further by adding a significant 3D premium.

As a result the theatrical sector, which already accounted for $31bn, or 50%, of worldwide movie spending in 2011, will rise to $41bn or 59% of the total by 2015. Almost $6bn of that increase will have come from the developing regions of Asia Pacific, CE Europe and Latin America with a further $4bn generated by North America and Western Europe. Despite the declines in some other sectors, this growth will help swell worldwide transactional movie spending to almost $70bn in 2015.

Consumer behaviour and attitudes around movie viewing will be a key topic for discussion at this year's PEVE Entertainment conference, to be held at the British Museum in London on 27-28 March 2012. For more information see www.screendigest.com/events/peve.

RICHARD COOPER is a Senior Analyst in Screen Digest's Video team where he is responsible for the ongoing development of the online Video Intelligence service, including designing, constructing and maintaining the detailed computer models that underpin Screen Digest's video forecasts. His other responsibilities include tracking the expanding Blu-ray Disc replication sector and monitoring trends in emerging markets.

Story filed 08.02.12