Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

FEATURE: The slow, but inexorable march of 3D in the home

Now that 3D has broken into the market, what form will it take within the home? Will it be accessed on-demand or through a dedicated channel, streamed via IP or through a set-top box or Blu-ray Disc player, or viewed with passive polarised glasses or the active shutter variety? TOM MORROD, Head of TV Technology at IHS Screen Digest, looks for answers.

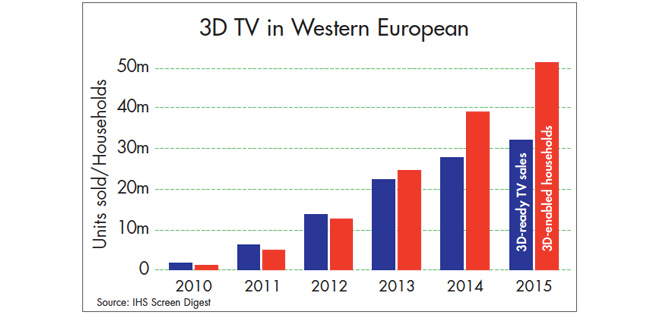

Since the beginning of 2010, when 3D in the home became a viable proposition, the rollout of 3D services and hardware has been one of mixed success. Within Western Europe, shipments of 3D-ready TVs, those that can output a stereo 3D image, totalled 1.4m, just 3% of total sales – lower than originally anticipated, with sales initially hindered by premium pricing. The outlook was similar for Blu-ray players, where 6% of all models sold were 3DBD, but was far more promising for set-top boxes, where 84% of all pay-TV STBs shipped were 3D-capable.

The 3D ecosystem can be characterised into three basic stages: content creation, content delivery and consumer hardware. Film studios and content producers generate 3D content; which TV operators, broadcasters and over-the-top service providers then aggregate; and consumers subsequently watch with appropriate 3D hardware, such as 3D-capable TVs, set-top boxes and BD players. But each of these stages depends heavily on the others – with no hardware, there would be no value in aggregating and selling 3D content; and with no 3D content, what use is a 3D TV in the first place?

In a sense, these concerns are relatively inconsequential – provided all involved parties desire the expansion of 3D viewing, the technology will inevitably pervade and become widely adopted, at least at a hardware level.

In 2015, there will be 66m 3D-enabled TV sets in Western Europe, those that have glasses and other needed hardware, of 99m 3D-ready TVs installed – this means that over 30% of TV households will be able to watch 3D if a content source is plugged in. At these levels of adoption, a viable market will exist for appropriately marketed and packaged 3D content, in a manner akin to the now wide-spread acceptance of HD channels and television sets.

The more interesting issue now is the form 3D will take within the home – whether accessed on-demand or through a dedicated channel, streamed via IP or through a set-top box or BD player, or viewed with passive polarised glasses or active shutter glasses.

The demand for in-home 3D

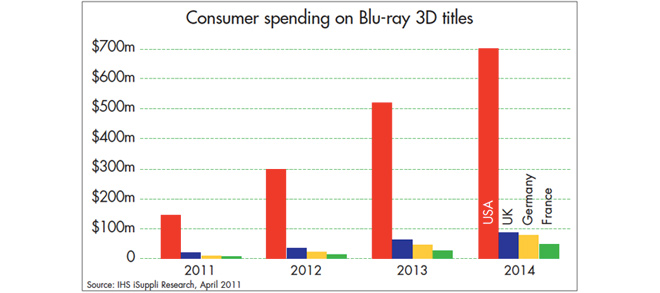

The demand for 3D within the home originated from content and service providers, as part of a desire to emulate the additional revenues derived from 3D films at the cinema. On average, 3D films add 20% to box office revenues in comparison to those in 2D – indicating at the very least a demand amongst consumers for premium 3D content. As a medium, TV offers a broader range of premium events – in addition to films, many major sporting and cultural events are shown on live TV, and in-home 3D offers a path by which these can be even more successfully monetised than in 2D.

This in turn has created a 3D hardware market, and an opportunity for manufacturers to profit, particularly in the case of TVs and BD players. Manufacturing and selling TVs is traditionally a low-margin business, with high-demand and minimal product differentiation creating intense competition.

The emergence of 3D offered an opportunity to market a new product type, and profit from it accordingly, particularly because the technology required in rendering a set 3D-capable was relatively cost-effective. But this opportunity is short-term – the average price of a 3D TV fell dramatically over 2010, and with 3D models in 2011 entering the market at more accessible 32-inch and 37-inch sizes, will continue to fall. The sense of urgency currently amongst 3D TV manufacturers comes from a desire to capitalise on high-end hardware sales now, before 3D becomes embedded in consumers’ minds as a standard feature.

In the case of BD players, the dynamic is slightly different. With DVD player sales still high and a large installed base of BD-capable games consoles, such as the PS3, consumers need a more potent reason to purchase a standalone 3DBD player.

In recognition of this, BD standards have evolved rapidly; since 2007, four BD profiles have been developed for the market, with the internet-enabled profile 2.0 (BD-live) and the 3D-capable profile 5.0 (3DBD) beginning to dominate shipments. BD 3D offers next-generation BD players a significant differentiator from any DVD players, and has enabled the retention of a high-end market with increased profit margins.

3D broadcasting

Thus far, European service providers have dominated the broadcast of 3D content. In 2010, there were 81 3D channel launches worldwide, with 53% of these occurring in Europe. Excluding 13 trial services, this gave a total of 30 confirmed 3D channel launches in Europe, representing impressively quick mobilisation from service providers in the first year of commercial in-home 3D services.

The motivation for this is clear: for dominant pay TV operators, such as BSkyB in the UK, there is an opportu-nity to monetise the additional programming and to develop consumer brand-association with 3D content; whereas for operators in competitive markets such as France (where 3D channels were launched by eight separate operators), the priority is the need to maintain market position.

The real decision that broadcasters and operators have to make is how best to package 3D content. It would be fair to say that, so far, opinions remain split – of the 30 confirmed channel launches in Europe, eight are video on demand (VOD), nine were one-off channels dedicated to a specific event (most commonly the World Cup or Roland Garros) and the remaining 13 were dedicated 3D channels, with a regular schedule of programming. With the limited amount of 3D content available, most of the dedicated channels are limited to just one per operator, with the notable exception of Free in France, which has four.

However, the issue with such channels is that they tend to have a rather arbitrary content offering – a selection of movies, sports and other content that does not target any one or two specific demographics. Distributing on-demand content can solve this issue, but so far VOD has been relatively exclusive. Indeed, with six of the eight launches occurring within France, Netherlands and the UK, we can see that any viable VOD service requires both advanced hybrid device penetration and a substantial subscriber base. Interestingly, this is not unique to operators and broadcasters – hardware manufacturers such as Samsung, which has a substantial installed base of hybrid devices, and launched its own 3D VOD services in 2011.

What is in agreement however is the type of content that 3D can add value to – specifically film, entertain-ment and sports – which were prevalent on 83% of all 3D channel launches worldwide in 2010. This is very much indicative of an event-based approach to 3D, with viewing driven by specific programmes, rather than the more passive, ‘convert everything to 3D’ approach. With auto-stereoscopic (glasses-free) 3D still far from being a consumer proposition, 3D TVs will need glasses for some time yet, forcing the viewer to be more engaged in the viewing experience than with 2D TV. Both VOD and dedicated 3D channels are plausible mecha-nisms for aggre-gating desired content and monetising it – but need to be utilised based on available content and consumer viewing habits within a country.

The state of 3D hardware

At present, there are two contrasting forms of 3D viewing technology available to a consumer, based on the type of 3D glasses required to interact with the display format in the screen. The first utilises ‘passive polarised’ glasses, which polarise (or filter) the light from the TV into orthogonal planes, which subsequently project a different image to each eye. This technology, commonly used in cinemas, effectively halves the resolution of the image viewed when transferred to the TV screen as both the left and right polarisation needs to be overlaid on a pre-existing screen size – such as a 720x1280 panel – giving each the right and left eye half of the total real-estate. But passive has the bonus of providing light and easily affordable glasses.

Conversely, ‘active shutter’ glasses require heavier and more expensive glasses, but offer full resolution quality – the left and right-eye images alternate on the screen at high speed, and the glasses sync together with the TV, opening and closing alternately so that each eye can only see the appropriate image. The difference is fundamental – passive polarised technology pairs complex TV sets with simple glasses, whilst active shutter technology pair simple TV sets with complex glasses.

The current landscape for glasses technology reflects the uncertainty of manufacturers, with Samsung, Sony and Panasonic promoting active shutter glasses, LG and Vizio promoting passive polarised and Toshiba and Philips currently supporting both technologies. So far, active shutter glasses have been the dominant format – comprising 74% of the 1.5m 3D-ready TVs sold in Western Europe in 2010. Part of the reason for this initial ascendancy is certainly the support of Samsung, the pre-eminent early exponent of 3D TVs, for active shutter technology.

With this is mind, the proportion is expected to change over the coming years, coming down to around 55% by 2015, although active shutter glasses still remain dominant. Taking into account the current resolution of a typical TV set, the ability of active shutter technology to offer Full HD 3D, in contrast to the SD 3D experience of passive polarised, is a huge advantage – but as the resolution increases in the future generations of TV sets, passive technology may well prove more effective in the long run, as a simpler, easier user-experience.

The cost of glasses has a significant impact on the actual usage of 3D-ready TV sets shipped into the market. Many active 3D-ready TVs will be shipped without expensive active shutter glasses in the box, thereby requiring a consumer aftermarket to purchase 3D glasses to create a 3D-enabled TV set, one with glasses and a compatible screen.

Early adopters will initially ensure that a high number of screens come with compatible glasses as manufacturers look to seed the market with usable 3D. However, over time the cost of active glasses will reduce the proportion of TVs shipped with active glasses. Within the same period of time, passive polarised TV sets with very cheap glasses will start to be sold, maintaining good penetration of 3D-enabled TV sets. Finally, as 3D content becomes more established existing active 3D TVs without glasses will buy glasses as well, as prices fall into a commodity mass-market.

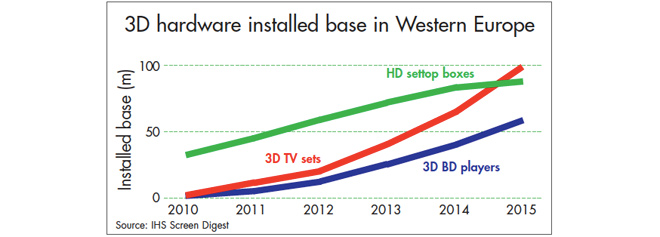

Providing content to these 3D-enabled TV sets is likely to come via two major device types: the pay TV set-top box and the BD player. Of these possibilities, STBs have certainly had the head start advantage. It is possible for 3D to be broadcast through any existing pay TV HD STB (though any pre-2010 legacy STBs, all broadcasts are at half-resolution), via frame compatible broadcasting. This gives a huge potential installed base of 3D-capable STBs within Western Europe, already 35.5m in 2010, and rising up to 86.9m by 2015.

It seems certain, for the time being at least, that this will become the dominant method of receiving 3D broadcasts within Europe – the STB has almost total coverage amongst pay TV operators, and legacy HD STBs offer an immediate route to current consumers.

Yet, the outlook for BD players also seems promising – 2010 was the launch year for 3DBD, and early sales figures have been good, with the 289,000 sold in 2010, set to be followed by a further 3.7m in 2011. If we assume that any future BD standards will build upon DBD and incorporate 3D-compatibility, this translates into an installed base of 62m standalone 3DBD players in Western Europe in 2015. When combined with the HD STB installed base, there will be just under 150m 3D-capable BD players and STBs in Western Europe – more than enough to account for each 3D TV set.

TOM MORROD is Senior Analyst for TV and broadcast technology at IHS Screen Digest. He has developed the TV Technology Intelligence service and is responsible for all related projects focused on the technology value chain. Prior to joining Screen Digest, Tom has worked in content acquisitions and television rights distribution, and in independent theatres. He holds a BA Honours in Economics from the University of Nottingham and a MA in Creative and Media Enterprise from the University of Warwick. Contact: Tom.Morrod@screendigest.com

This is one of many editorial features included in the annual DVD and Beyond 2011 magazine. Ask for your free copy.

Story filed 12.10.11