Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

Sharp growth predicted for 3DTV sets; Chinese most enthusiastic

In the 2011 edition of its wide-ranging consumer research, Finding Growth: Emergence of a New Consumer Technology Paradigm, the global management and technology consultancy Accenture predicts 3D TV will have the highest change in purchase rate – a staggering 500% increase – in the next 12 months. To date, only 3% of the surveyed population own a 3D TV set. China stands out as the most enthusiastic consumer of new technologies.

For four consecutive years, Accenture has conducted research to identify and track preferences for consumer technologies and services. For the 2011 report, the company conducted a quantitative online consumer study comprising 8,002 interviews across eight countries: the US, Japan, Germany, France, Brazil, Russia, India and China. The research, fielded in October and November 2010, sought to cover a demographically representative sample across all the geographies. In Brazil, Russia, India and China (the BRIC market), the sample is representative of the urban and semi-urban population.

What was purchased in 2010? Mobile phones and computers were the consumer electronics devices purchased by the most respondents in 2010. Perhaps because these devices are the most ubiquitous globally, the largest percentage of consumers continued to buy them in 2010. However, as Accenture’s Power Rankings indicate, the growth rate in mobile phone and computer purchases is showing decline.

The third-most purchased consumer technology was high-definition TVs, bought by 23% of respondents. As the latest technologies to hit the market, tablet PCs, 3D TVs and e-book readers were purchased by small minorities of respondents. Yet, many more consumers anticipate purchasing these technologies in 2011. VCRs were the least purchased technology in 2010, purchased by only 1% of respondents globally.

Overall, more respondents in emerging markets made purchases than in mature markets: 87% of emerging-market consumers made purchases last year compared with 71% of mature-market respondents. This more conservative purchase behavior in Japan, the US and western Europe is understandable, given the uncertain economies faced by each of these countries last year and the comparative lack of enthusiasm about technology because it has been affordable and accessible to many of these consumers for years.

What is being discarded as obsolete? Perhaps a leading indicator of growth challenges for particular types of devices is what consumers stopped using because they feel they have the same functionality in another device. The devices that the greatest percentage of surveyed respondents have stopped using are the VCR and regular TV. Perhaps that helps to explain why the purchase rate for regular TVsets is expected to decline by 50%.

The Accenture study reveals that emerging markets are quicker to let go of duplicative technologies than are mature markets, particularly mobile phones, regular TVs, DVD players and VCRs. More than 10% of respondents stopped using these devices in BRIC countries last year. This is in contrast to mature markets, where no more than 9% stopped using any device.

The most-used consumer technologies The top five consumer electronics in terms of those used most often include (in order of most frequent use): smartphone, computer, mobile phone, high-definition TV and regular TV. Given that smartphones are only 10th in the Power Rankings (owned by 28% of the respondents), it’s clear that those who own them use them heavily. Of note: consumers in every country rank the same technologies among their most often used, with slight variations within their order in the top four ranks

What consumers plan to purchase in 2011? The technologies that most respondents intend to purchase within the next 12 months include high-definition TVs, smartphones and computers. In general, those devices with the largest ownership base are also those continuing to be purchased.

Interestingly, one-quarter of respondents globally don’t plan to purchase any consumer technologies in 2011. More than one-third (37%) of those 55 and older don’t plan any purchases, compared with only 15% of those between 18 and 24 years of age. And a stark contrast in purchasing plans exists between mature and BRIC markets: 40% of respondents in mature markets don’t plan to purchase any consumer electronics in 2011, compared with only 9% of those in the BRIC markets.

3D TV: What’s the real story?

The 3D TV sits dead last among the consumer technologies in Accenture’s 2011 Power Rankings because only 3% of the survey population currently owns one. However, the 3D TV also is predicted to have the highest change in purchase rate – a staggering 500% increase – in the next 12 months. So what’s the real scoop on the 3D TV?

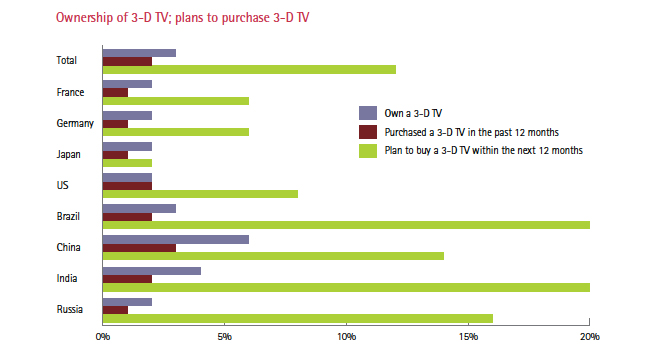

China once again stands out as the most enthusiastic consumer of new technologies. While 2 to 3% of consumers in most countries own a 3D TV, double that amount own one in China. And growth plans for 3D TVs in the BRIC markets are promising. During 2011, one-fifth of consumers in Brazil and India, 16% in Russia, and 14% in China plan to purchase a 3D TV. This is in stark contrast to just 2% of consumers in Japan, 6% in France and Germany, and 8% in the United States.

Of those who don’t currently own a 3D TV, overall interest in 3D TV is split: 49% globally say they are interested in owning a 3D TV and 51% say they aren’t. Interest is far greater among the younger generations: 63% of those 55 or older said they were not interested in 3D TV ownership, versus 45% of those under 25 and 46% of those aged 25-34.

In addition, there is much more interest in 3D TV among emerging-market consumers than mature-market consumers. Two-thirds of emerging-market respondents said they’d like to have a 3D TV versus only 31% of mature-market respondents. This interest within emerging markets holds steady across generations. Digging deeper into these market differences, it’s clear that countries differ significantly in consumer interest in this device. For example, 69% of Chinese and 68% of Russians want or plan to own a 3D TV, versus only one-fourth of US consumers and one-fifth of consumers in Japan.

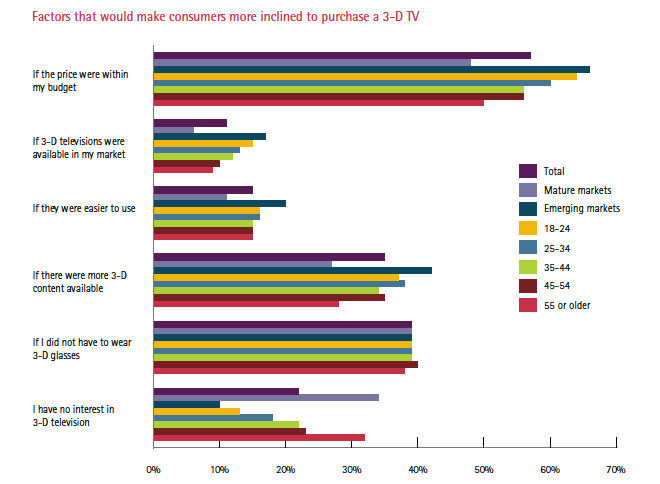

As consumer electronics companies consider ways to increase demand for 3D TVs, it appears price is the biggest lever that would drive more interest in this new device. Fifty-seven percent of respondents globally said they would be more inclined to purchase a 3D TV if the price was within their budget. Finding a price within their budget was more significant among people under 24 years old than older people (64% versus 50%, respectively). And finding a price within budget is a bigger driver of 3D TV purchase interest in emerging countries than in mature ones.

Other (but lesser) factors that would make consumers more inclined to purchase a 3D TV include having greater availability of 3D content and not having to wear 3D glasses. Almost half (45%) of respondents in China and Germany said they’d be more inclined to buy a 3D TV if they didn’t have to wear glasses. And also, in China, 63% said they’d be more interested in 3D TV if there were more content available.

Story filed 17.01.11