Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

ANALYSIS: Mobile Video - the rise of the Apps

Combining two of the most popular services – mobile and television – has always been an attractive proposition. Once seen as a massive opportunity by operators and broadcasters, mobile video has fallen to the bottom of the list, replaced by social networking and apps. RONAN DE RENESSE, Senior Analyst at Screen Digest, examines the trends.

Many operators launched services in the first half of the decade, but uptake of these services has been mixed at best, and in most cases failed to meet operator expectations.

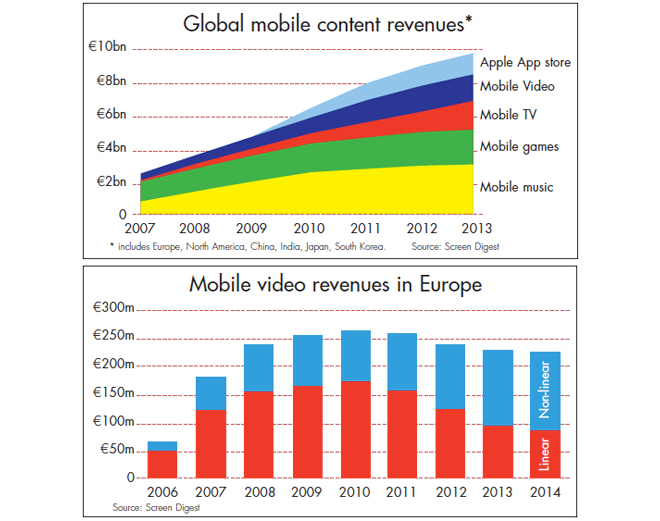

In 2008 in both Western Europe and North America, mobile video made up less than one percent of total mobile content revenue. A combination of new devices and stores is changing the status quo. Smartphones with large high-quality screens are driving user demand while mobile application stores are breaking down network operators’ traditional walled garden approach to content delivery. While consumption has consequently risen throughout 2009, revenues remain low as application stores adopt online business models and mobile advertising is still in its infancy.

Sports, sports and more sports

News and sports have historically been the most popular categories in mobile as instant access to information and live entertainment is more relevant in a mobile context. In the UK, for instance, over 80% of paid-for mobile video subscriptions are for sports packages. Sports content on mobile takes various shapes; ranging from full-fledged premium sport subscription packages at $10 a month, to mobile games, fan apps and SMS score alerts.

With the 2010 Football World Cup taking place in South Africa in June, demand for video content on mobile has undoubtedly risen. Mobile operators and media companies have been gearing up their mobile video strategy accordingly.

– South Africa, Ghana, Kenya, Morocco, Namibia and Nigeria have all deployed mobile broadcast TV networks and are heavily relying on the Football World Cup to boost uptake.

– TV-enabled handsets are shipping in large numbers to South America; chipset firm Telegent Systems is selling 3.75m mobile TV receivers a month.

– Nokia launched a DVB-H/DVB-T compatible handset, the Nokia 5330 Mobile TV Edition, in November 2009.

– UK broadcaster ITV launched an iPhone application and web app that offers live streams of all ITV World Cup broadcasts.

– US broadcaster ESPN is streaming 56 World Cup matches to its US mobile TV subscribers. The 56 games are available from each of the major US operators – Verizon, Sprint and AT&T. After two days of the World Cup, ESPN reported 8.2m people had accessed its mobile web and app coverage, generating 50.4m page views and 550,000 video views.

Mobile apps bring a new dimension

In July 2008, Apple launched the App Store, offering a new distribution platform for mobile content to a limited, but engaged high-end consumer base of iPhone and iPod Touch users. Although application stores were initially developed by mobile operators to complement 3G offerings, Apple's App Store massively improved the user experience by tailoring its store front and application development platform to only two device models (iPhone and iPod Touch) instead of hundreds.

Thanks to a strong marketing campaign and the integration of iTunes’ billing platform, Apple served more than 3 billion app downloads in 18 months; equivalent to five times the global number of games downloads on mobile operator portals over the same period. For media companies, mobile applications offer the opportunity to:

– increase the length of the relationship with consumers by making content accessible anywhere at anytime

– create a more intimate contact with the audience with interactive features evolving around key TV programmes

– improve brand image by creating ‘cool’ apps

– increase viewership and address an audience unreachable on any other platforms

– generate additional revenues through paid downloads/subscriptions and/or advertising

A single application is not enough to achieve all of the above. While some applications aim to entertain mobile users by providing access to repurposed content, other popular applications tend to be more innovative by taking advantage of the mobile experience to bring another dimension to existing services. In January 2010, US media company NBC Universal featured 29 applications on the App Store ranging from local news to horoscope (hormonOscope), veterinary (PetVet) and comic book (Heroes Comic Reader) applications.

There are many other ways in which applications can be useful to TV companies. Mobile apps can be used to complement a particular TV programme (e.g. recipes from cooking shows, sports scores and analysis, local content and interactive reality TV features), improve the home entertainment experience (e.g. remote PVR access and TV guides) or simply for marketing purposes (e.g. sponsored games, jokes and utility apps). For example, Sky's remote control app generated 300,000 downloads only three weeks after its launch and quickly overtook its PC counterpart in terms of usage.

Catch-up on the move

So far, the mobile video market has been dominated by linear services and user-generated content simply because of low content costs. However, the smartphone /application store combination has pushed mobile operators to go beyond those simple models and transform their mobile video business to include premium video on demand rental services.

For example, 3UK has completely replaced its linear mobile TV service with a subscription video-on-demand service featuring episodes from popular TV series such as Lost, Friends, and Desperate Housewives. This trend is set to continue during the next five years, particularly in Europe where non-linear mobile video services will contribute 60% of mobile video revenues in 2014, up from 35% in 2009.

In addition to long-form premium rental services, the unprecedented success of online catch-up video services is progressively reaching the mobile space through Apple’s App Store or directly from the smartphone’s browser. BBC iPlayer, TF1 Player, SVT Play and TV.com (CBS) have all gained substantial traction on the iPhone and other high-end handsets. Although this places additional pressure on operators’ mobile video services, it is also a key driver for the adoption of mobile data packages which offer smaller profit margins but on a much larger scale.

Unlimited access reaches its limit

In June 2010, AT&T switched its unlimited mobile data package to variable pricing as a result of exponential growth in mobile data consumption across its 3G network. Similarly, in the UK, O2 and Orange have put more emphasis on fair use policies by offering new data pricing models and explicitly integrating data allowance in smartphone contracts.

Similar to an ‘all-you-can-eat’ buffet at a restaurant, the pricing model is based on the assumption that consumption will remain below a specific threshold. However, in the case of mobile data services, the number of users has increased exponentially in the past 12 months. While heavy users may represent less than 5% of the total smartphone user base, the number of such users is rising at the same pace, taking up more and more network resources. It would be similar to having a family of five eating the entire food buffet with nothing left for the remaining 95 customers.

The disparity between low and high mobile data users is impressive. O2 in the UK recently reported that only 3% of its customers use more than 500MB per month, which is 2.5 times higher than the average user.

The new data tariffs will, in fact, improve consumer experience by releasing network resources previously allocated to heavy users and bringing an additional revenue stream which will help accelerate infrastructure upgrades. Alternatively, smartphone users also have the option to use unlimited WiFi access for data-heavy applications such as multimedia streaming. More than 50% of mobile video consumption is done at home or in an office environment where Wi-Fi is very likely to be accessible.

The future of mobile is in the home

The home environment is becoming increasingly complex, with internet-connected TVs, games consoles and set-top boxes. Device manufacturers, network operators and pay-TV operators are all vying for a piece of the home entertainment market and looking for ways to differentiate through multi-screen strategies.

The mobile phone has always been present in the home, but has never really been used as part of home entertainment activities until now. With smartphones, the mobile handset has progressed from the status of a boring additional communication device to a separate exciting personal interactive connected screen.

Aside from toilet games console, bedroom TV, living room remote control and web browser, kitchen recipe book and garden camera, the mobile handset also connects people to their homes while on the move. Good examples of this are Sky and the Slingbox applications on Apple’s App Store. The ability to have remote control of, and access to, content which sits on other devices at home is a powerful high value offering for consumers and could eventually lead people back to paying for content.

Multi-screen strategies are progressively emerging in markets such as the US, the UK and France and tend to be dominated by telecom operators such as Orange and AT&T. However, content rights, technology fragmentation and business models integration are key roadblocks which are likely to hinder further adoption and therefore impact on the global content economy.

Mobile TV technologies

There are four ways in which to deliver video content to mobile handsets: sideloading, Bluetooth sharing, 3G streaming and mobile broadcasting.

A vast majority of video content present on mobile handsets has been either transferred from the PC (i.e. sideloading) or from a friend’s handset via Bluetooth.

In contrast to sideloading and Bluetooth, 3G streaming and mobile broadcasting are designed for anywhere anytime content access rather than content portability. In the Western world, the leading access technology for mobile video services is 3G (including HSDPA) with more than 80% subscriber market share.

Mobile broadcasting technologies such as DVB-H and MediaFLO have struggled to take off due to the lack of compatible handsets, expensive deployment costs and an inadequate regulatory environment. Since the beginning of 2010, more DVB-H based services have closed down than have launched, which clearly indicates that the technology is receding.

Outside Western markets – South Korea, Japan, China and Latin America – mobile broadcast is, on the contrary, the most popular technology to access video on the move. The main reason for this is that mobile broadcasting has been introduced as a handset feature – accessible for free, similar to the camera or FM radio, rather than an actual paid-for service.

Another technology that had almost no presence in the mobile TV market until last year is WiFi. With mobile video usage in the home or office accounting for over 50% of total usage, WiFi represents a good opportunity for operators to offload expensive 3G-based mobile video delivery.

RONAN DE RENESSE is Screen Digest's Senior Analyst for the mobile sector and has overall responsibility for the online Mobile Media Intelligence service and all related activities. He has been analysing the telecommunications industry since 2003. Ronan has a PhD in telecom from King's College London. Contact: ronan.derenesse@screendigest.com

This is one of the many high-caliber analyses in the annual DVD and Beyond 2010 magazine. Ask for your free copy.

Story filed 26.09.10