Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

The future of TV displays - no time to rest

The TV displays industry in Europe is in a state of flux with manufacturers desperately seeking ways in which to arrest the decline in unit sales and stimulate demand. DAVID WATKINS, Research Consultant at Futuresource, examines the challenges ahead.

In many ways the current period of market contraction has come as no major surprise given the completion of the various government-led digital switchover programmes which coincided with the rapid adoption of flat panel HDTVs. However, that has not stopped the industry pinning hopes on new technologies to encourage faster replacement of existing sets. Many hoped that 3D would be that technology to keep overall TV sales rising, but sales of 3DTVs have been slow, accounting for just 20% of European TV sales in 2012 and the 3D TV market continues to be held back by lack of content and a generally low level of consumer interest.

Having realised that 3D is unlikely to be the market saviour, TV vendors have turned their attention to a technology that they feel is more likely to spark consumer interest - 4K or Ultra HD. For some years now consumers have consistently placed picture quality and screen size in the top three of factors considered when purchasing a TV. 4K TV offers four times the resolution of standard 1080p HD video and models are currently available in sizes ranging between 50" and 85". Unlike 3D which was positioned as a new technology that would change the way we view TV, 4K represents a more natural progression for the industry, albeit one that brings its own problems.

The TV industry is facing a more fundamental challenge however, one that could threaten the very structure of the market as it is currently known. That threat is coming from the changing way in which people access and consume video content. Due to the staggering rise in wireless device ownership coupled with fast improving broadband speeds, consumers are increasingly choosing from a multitude of devices on which to watch video content. Thanks to their portability and usage as a source of content as much as a viewing device, tablets are increasingly being used as an alternative to a small screen TV in rooms outside of the main living room.

The effects are already being seen in the market with sales of TVs below 32" falling 16% in 2012 following a 10% decline in 2011. Therefore, the TV market is increasingly becoming a replacement market for the main screen living room set.

Sales of TVs across Europe fell 7% in 2012 to 63m units while revenues dropped 9% from 2011 to just over €31bn at retail. Unit sales in Western Europe fell 12% as the market continues to contract following the completion of the analogue-to-digital switchover programme. Furthermore, average replacement cycles have started to extend as ownership levels of flat panels ?approach saturation point. TV sales in Eastern Europe on the other hand grew 6% during 2012, fuelled by on-going digital switchover and relatively low flat panel ownership levels.

Despite the overall volume decline across Europe, extra-large TV set sales (those in excess of 46") continue to grow and accounted for 13% of total volumes in 2012, up from 11% in 2011. The 46" and larger screen size segment grew 14% in unit terms during the year with sales of 60"+ sets growing 26%. When it comes to replacing a main living room TV, the increasing affordability of large screen sets (50" displays are now easily attainable for well under €1,000) is encouraging consumers to replace their old TV with a bigger set.

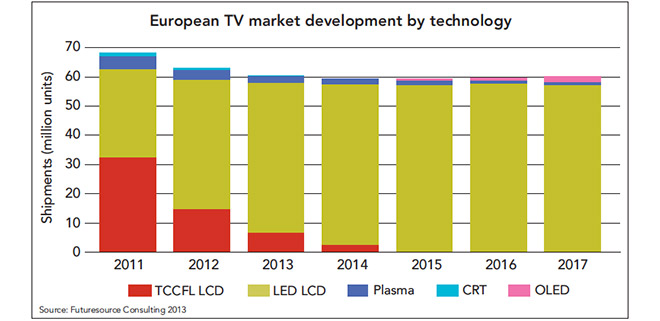

In terms of technology, LCD TVs accounted for 94% of all TVs sold in 2012 rising to an expected 96% in 2013. LCD TVs which utilise LED backlighting have all but displaced older CCFL based LCD sets, accounting for 89% of the LCD market in 2012. Futuresource anticipates that CCFL-based LCD sets will no longer be available by the end of 2015. Demand for plasma is falling fast as its price advantage over LED at larger sizes is eroded and the remaining plasma vendors focus more of their attention on LED.

Leading plasma vendor Panasonic has confirmed that it will be ending production of plasma panels at its main Amagasaki plant in 2014 while rumours persist that it has developed its last generation of plasma panels. Meanwhile, the first large screen OLED TVs from LG and Samsung have started shipping in 2013. LG's 55" OLED set, available initially in the UK only, is priced at €10,000 and the company plans to launch its 55" curved version during the second half of the year; Samsung has already launched with its curved 55" set. Futuresource believes that the current low yield rates and high manufacturing costs for OLED TVs will result in a slow build-up of sets in the market over the next two to three years.

4K is the next step

With TV sales stuttering and 3D having failed to set the market alight, manufacturers are turning their attention to TVs with 4K or Ultra HD resolution in an attempt to inject some much needed revenue growth into the market and stimulate replacement demand now that many consumers have owned their flat panel TV for over seven years.

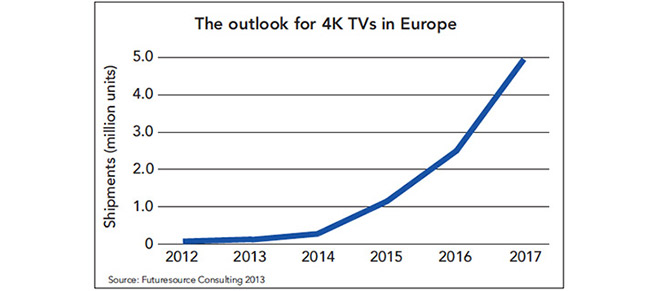

Given the current high price points, a lack of native 4K content and the limited size of the large screen TV market, Futuresource sees a gestation period of two to three years before 4K screens start to build as a significant element of the global consumer TV market. Sales of 4K or Ultra HD TVs are still very much in their infancy with around 15,000 units expected to be shipped across Europe in 2013 up from just 1,000 units in 2012.

By 2015, panel makers are expected to have reduced the cost of producing a 4K panel to a level approaching an equivalent 1080p panel. This will encourage faster adoption of the technology although it is anticipated that TV vendors will aim to attach a premium to a 4K TV for as long as they can in order to boost profits and recoup some of the heavy investment made into the development of the technology.

In the wider global market, China is expected to account for the majority of worldwide 4K TV shipments over the next couple of years due to the aggressive rollout of low-cost 4K models from all of its leading domestic brands. Several Chinese brands including TCL, Hisense and Haier are targeting international expansion as growth in their domestic market slows and it is possible that they may aim to make their mark internationally by offering 4K TVs at prices considerably lower than the established Japanese and Korean brands. Europe may well prove to be more protected than other regions from such a trend due to the complex broadcast landscape that exists which makes TV set design a significant challenge for any new market entrant.

The growth of Smart TV

Smart TV is steadily moving mainstream as it becomes a standard feature on the mid-high end ranges of the major TV vendors. Europe was the leading market by shipment volumes in 2012 followed by China and North America while Japan leads in terms of overall sales penetration of Smart TV. Across Europe, Smart TV is expected to account for 49% of sales during the year, up from 34% in 2012. There are significant differences in terms of uptake across the continent however with sales penetration already in excess of 60% in markets such as Germany, Switzerland and the Nordics while Smart TV accounts for less than 40% of sales in the UK, France and Italy.

Video continues to be the main driver of usage, particularly Catch-up TV programming and premium video-on-demand content and manufacturers are making the experience more enjoyable and intuitive by adding sophisticated search and recommendation engines to their sets.

Smart TV vendors are also leveraging the explosion in ownership of iOS and Android tablets and smartphones by enabling consumers to push and pull content to and from the TV while also making available applications that turn the portable device into a TV remote control.

A question mark remains over whether second and third tier TV brands will add smart TV functionality to their ranges due to the relatively high cost of maintaining a smart TV platform. Third party smart TV platform providers such as Roku offer a set-top box/USB stick solution for consumers looking for smart TV functionality without wanting to upgrade to an integrated smart TV.

In the USA, several smaller TV brands have partnered with Roku to offer its 'streaming stick' product as part of a bundle with their TVs. However, longer term, Futuresource believes that such functionality will move increasingly into the TV display itself as the platform providers will prefer to focus on the software elements of their service rather than continue to play in an increasingly competitive hardware business.

TV vendors need to adapt to meet multi-screen challenges

Improvements in the design and features of TV sets will generate replacement sales, but these alone will not bring the market back to the growth levels that we have seen in the past. ?Offering access to content wherever and whenever the consumer wants it is critical and brands are already developing their connected TV platforms with this in mind. Samsung is experimenting in some European markets by offering TeliaSonera's IPTV package built into its sets.

Some observers anticipate subsidised sets being supplied as part of a Pay-TV contract - along similar lines to mobile phones. This might imply more regular upgrades for the consumer. Such schemes are likely to be among those explored by TV vendors who will certainly need to constantly adapt their products and business models to meet the changing needs of the consumer.

DAVID WATKINS has more than six years' experience in research and consultancy. He heads Futuresource's TV research and analysis team, tracking and forecasting the global consumer electronics market with a focus on flat panel TV. He also monitors the uptake of Smart TV and 3DTV and challenges faced by vendors and retailers. Contact: www.futuresource-consulting.com....

On predicting the future

Predicting the future, let alone the future of packaged media, is a perilous exercise, and possibly counter-productive, as the exercise closes doors rather than keep them open, argues JEAN-LUC RENAUD, DVD Intelligence publisher. Consider that: Apple was left nearly for dead 15 years ago. Today, it became the world's most valuable technology company, topping Microsoft.

Le cinéma est une invention sans avenir (the cinema is an invention without any future) famously claimed the Lumière Brothers some 120 years ago. Well. The cinématographe grew into a big business, even bigger in times of economic crisis when people have little money to spend on any other business.

The advent of radio, then television, was to kill the cinema. With a plethora of digital TV channels, a huge DVD market, a wealth of online delivery options, a massive counterfeit underworld and illegal downloading on a large scale, cinema box office last year broke records!

The telephone was said to have no future when it came about. Today, 5 billion handsets are in use worldwide. People prioritize mobile phones over drinking water in many Third World countries.

No-one predicted the arrival of the iPod only one year before it broke loose in an unsuspecting market. Even fewer predicted it was going to revolutionise the economics of music distribution. Likewise, no-one saw the iPhone coming and even fewer forecast the birth of the developers' industry it ignited. And it changed the concept of mobile phone.

Make no mistake, the iPad will have a profound impact on the publishing world. It will bring new players, and smaller, perhaps more creative content creators.

And who predicted the revival of vinyl?

(click to continue)... Read More...